For a related article click here for Wikipedia's latest report on Gold Production and Gold Mine Reserves by Country

According to this article on the silver standard, from the time of Spain's conquering of the "new world" the value of gold in relation to silver maintained a relatively stable ratio of 15½ over 1. A British pound note could be exchanged at the Bank of England for one gold sovereign (with 7.322 grams of gold) or 20 silver shillings (with 5.655 grams of silver), thus staying close to this ratio, and establishing relative stability with business and government contracts worldwide.

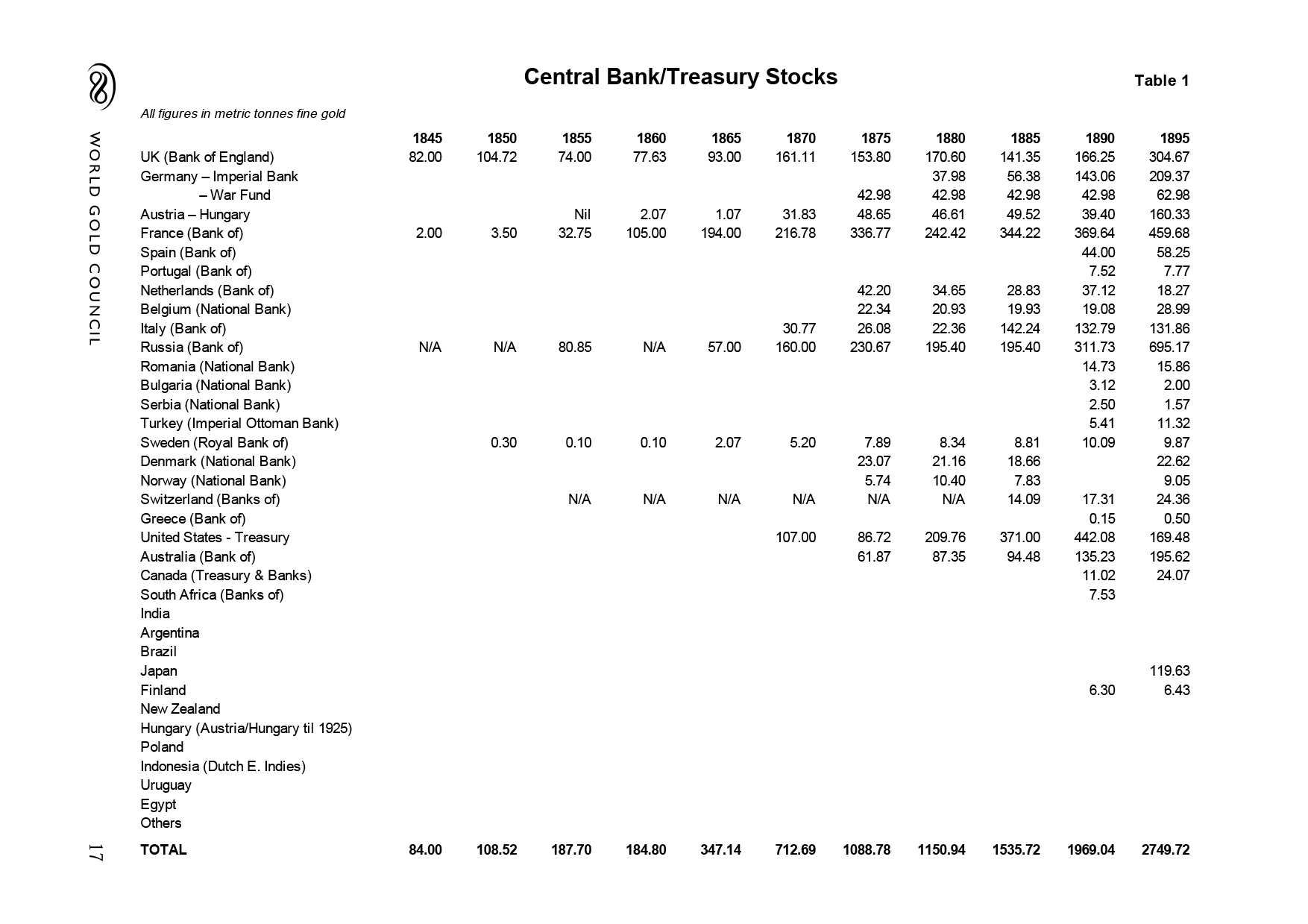

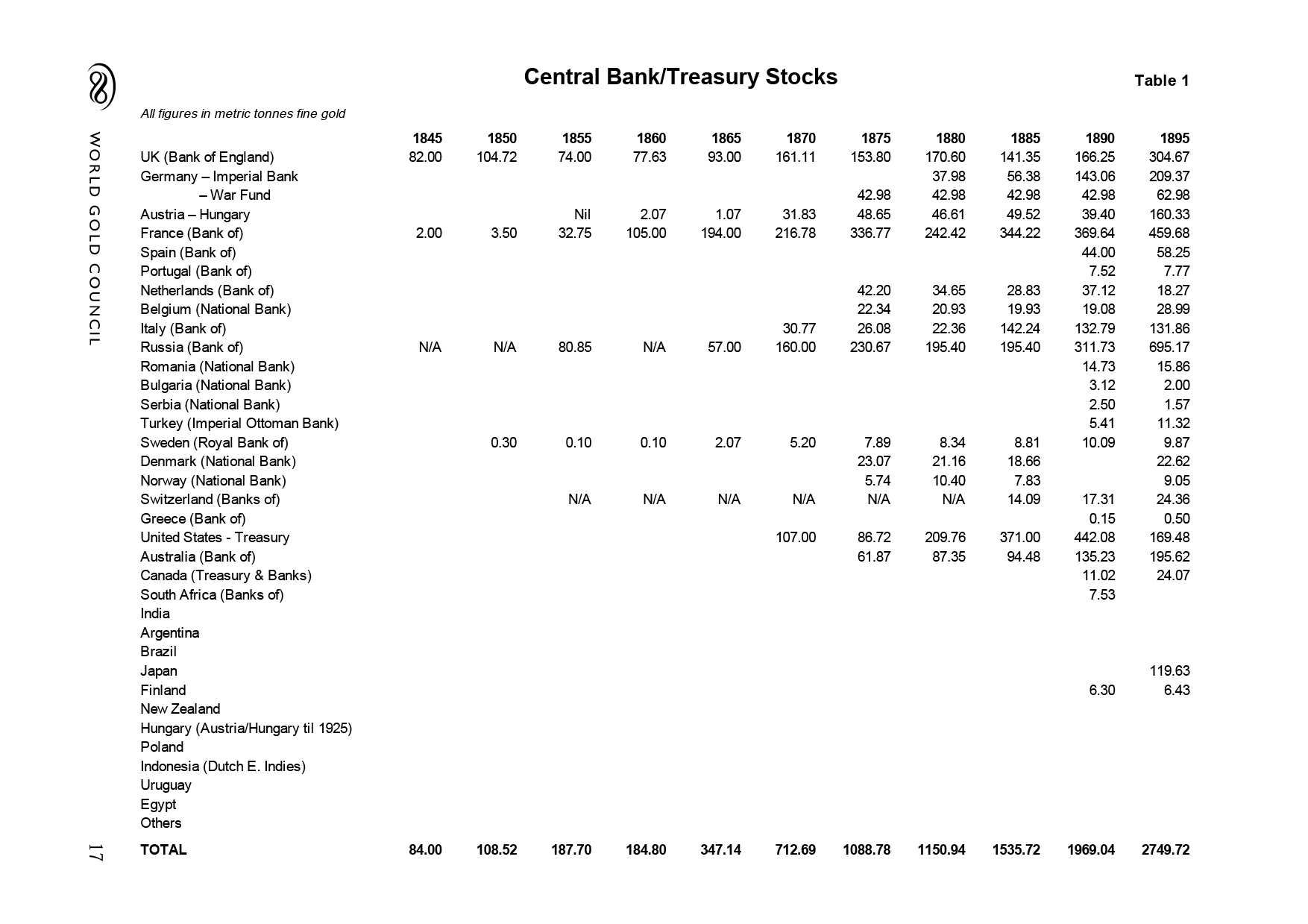

Table 1 Gold Reserves by Country 1845 - 1945

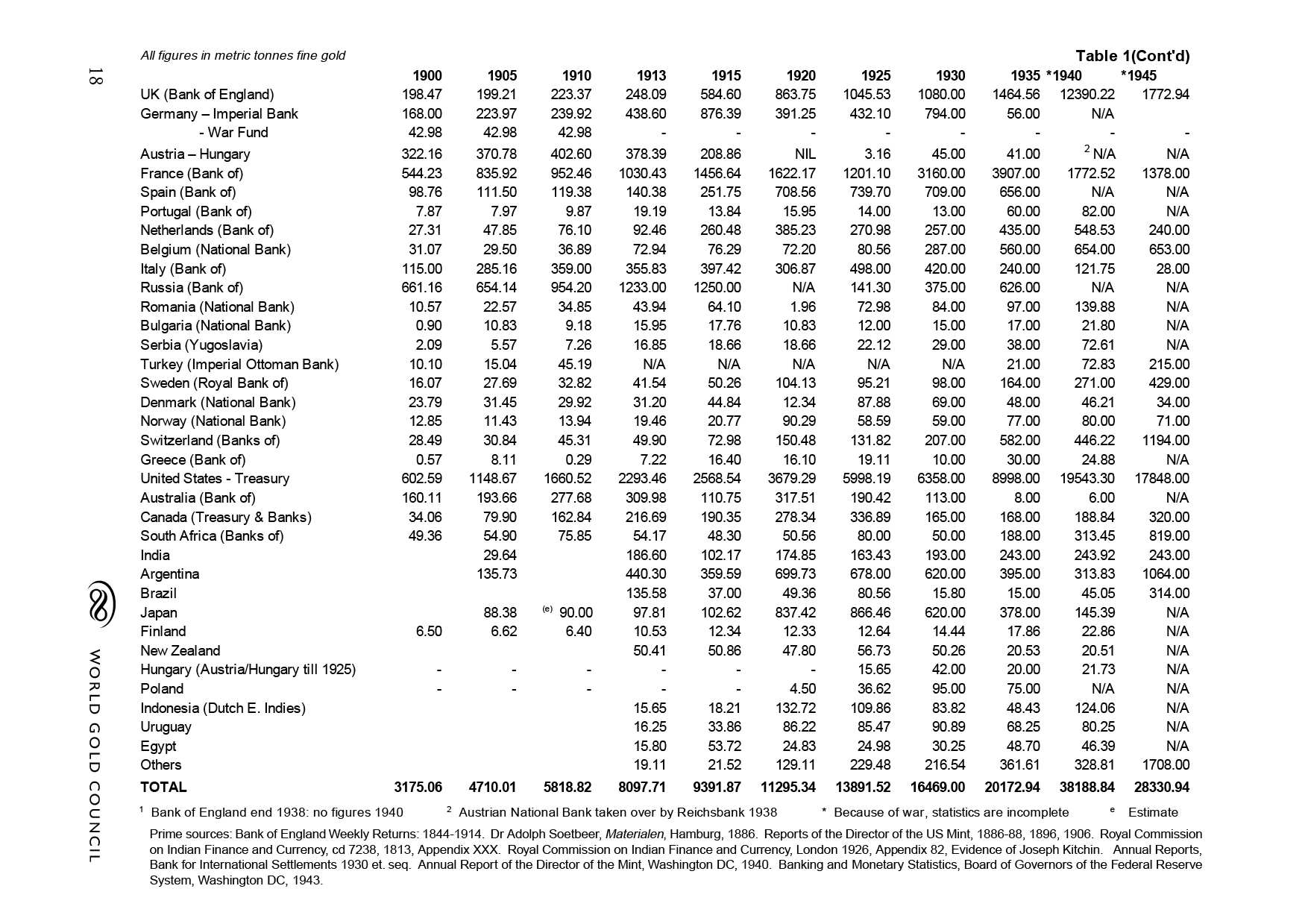

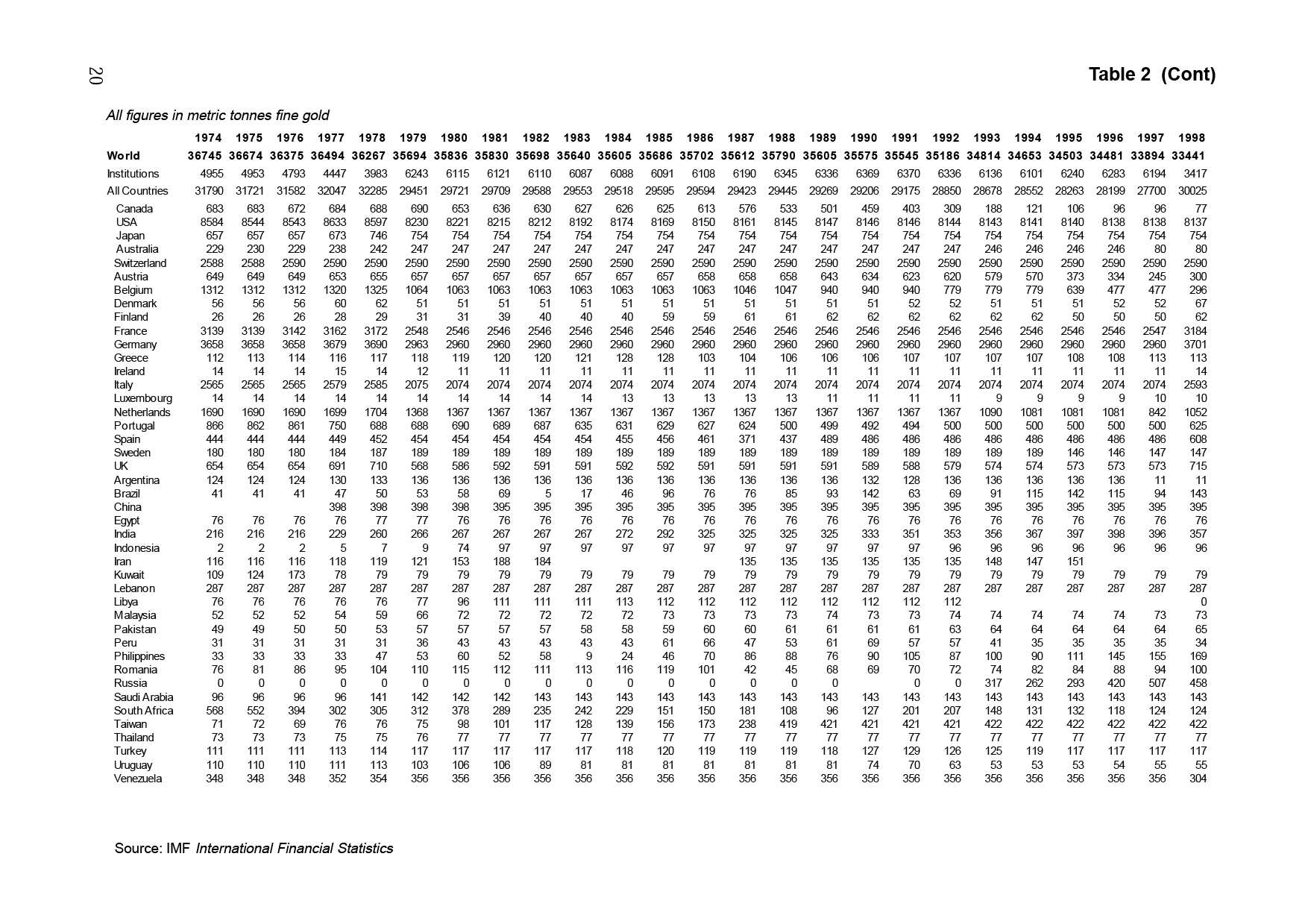

Table 2 Gold Reserves by Country 1950 - 1998

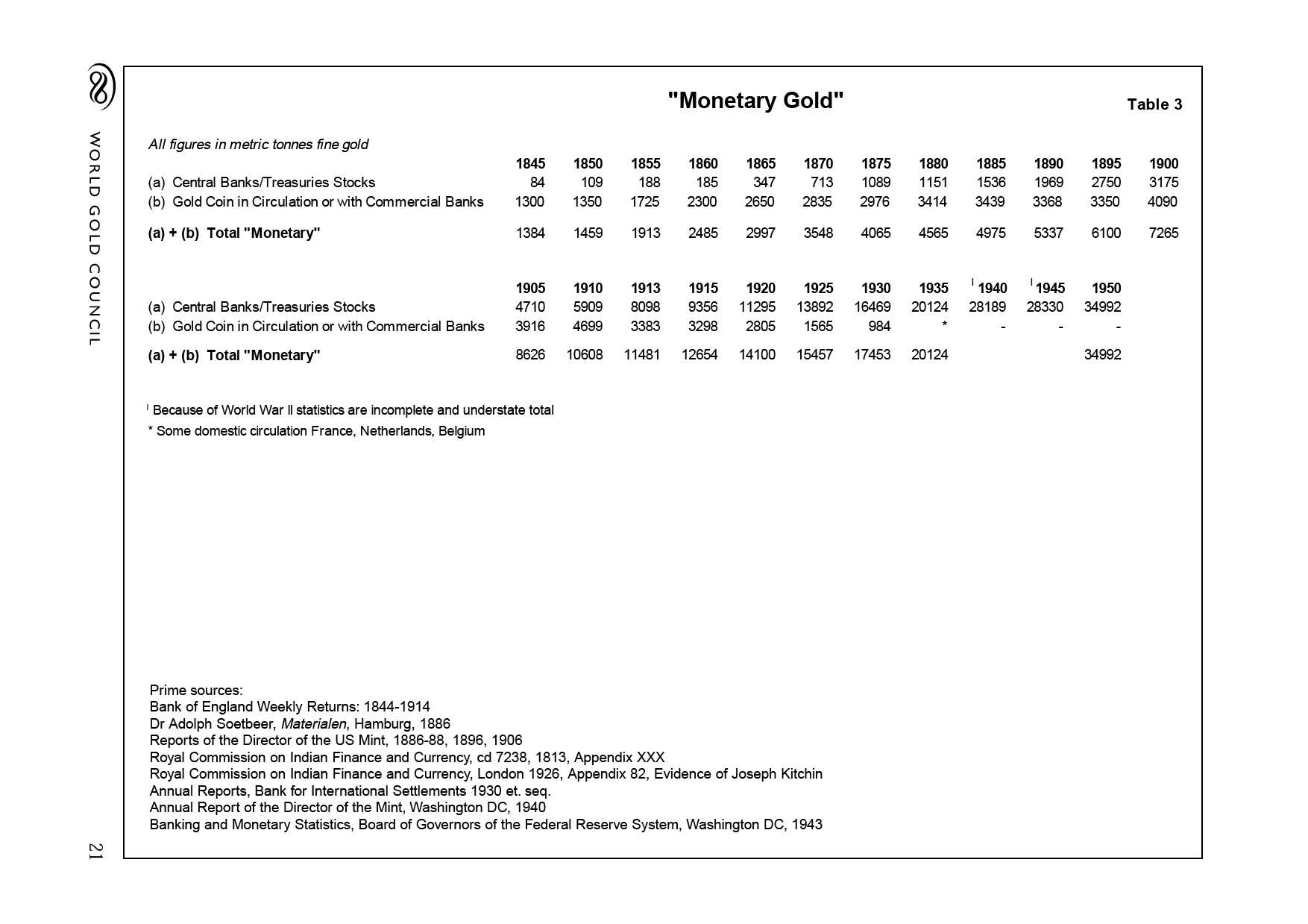

Table 3 Gold (Coins) in Circulation or in Central Banks 1845 - 1950

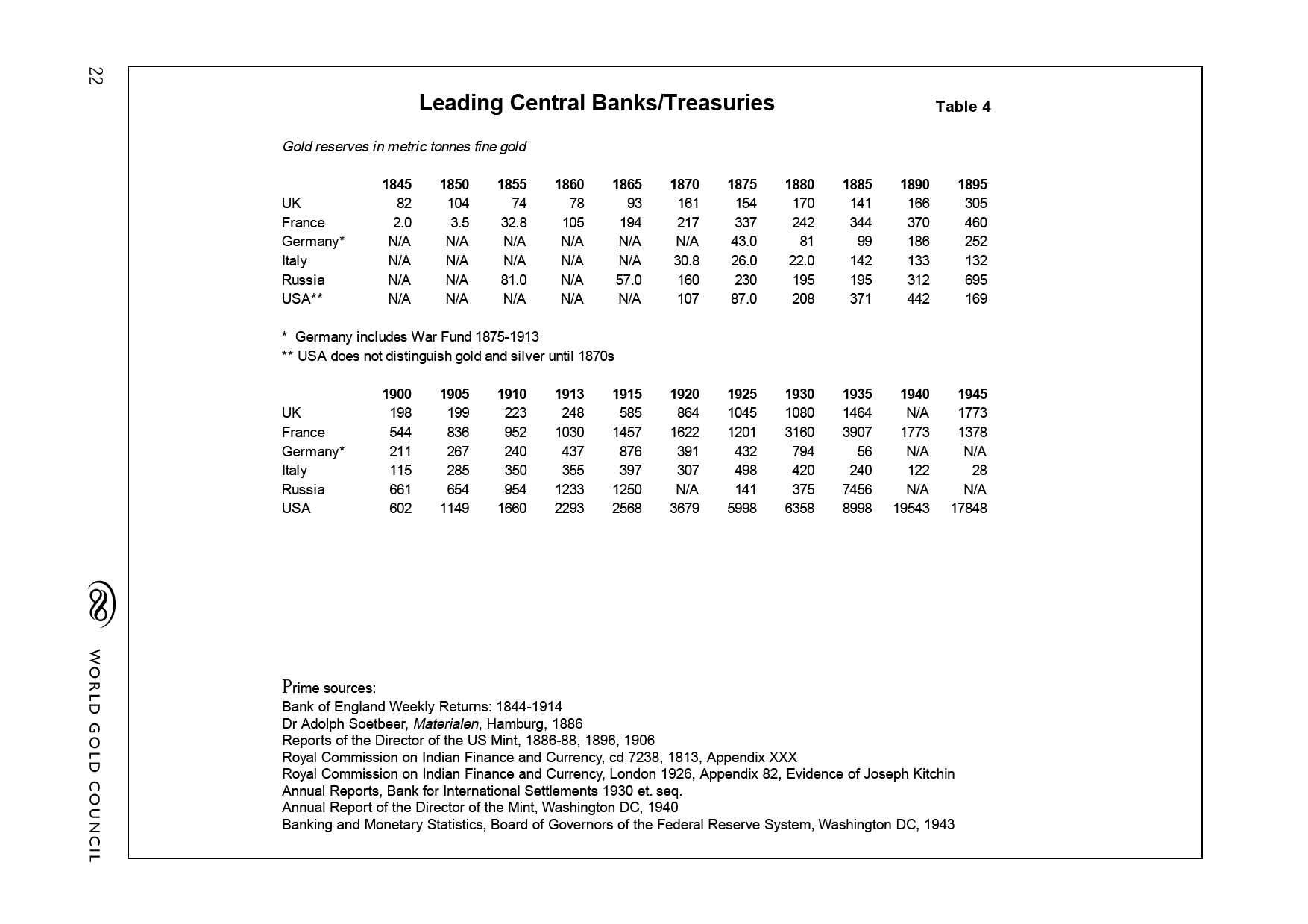

Table 4 Six Countries Central Banks Holdings 1845 - 1945 (UK, France, Germany, Italy, Russia, USA)

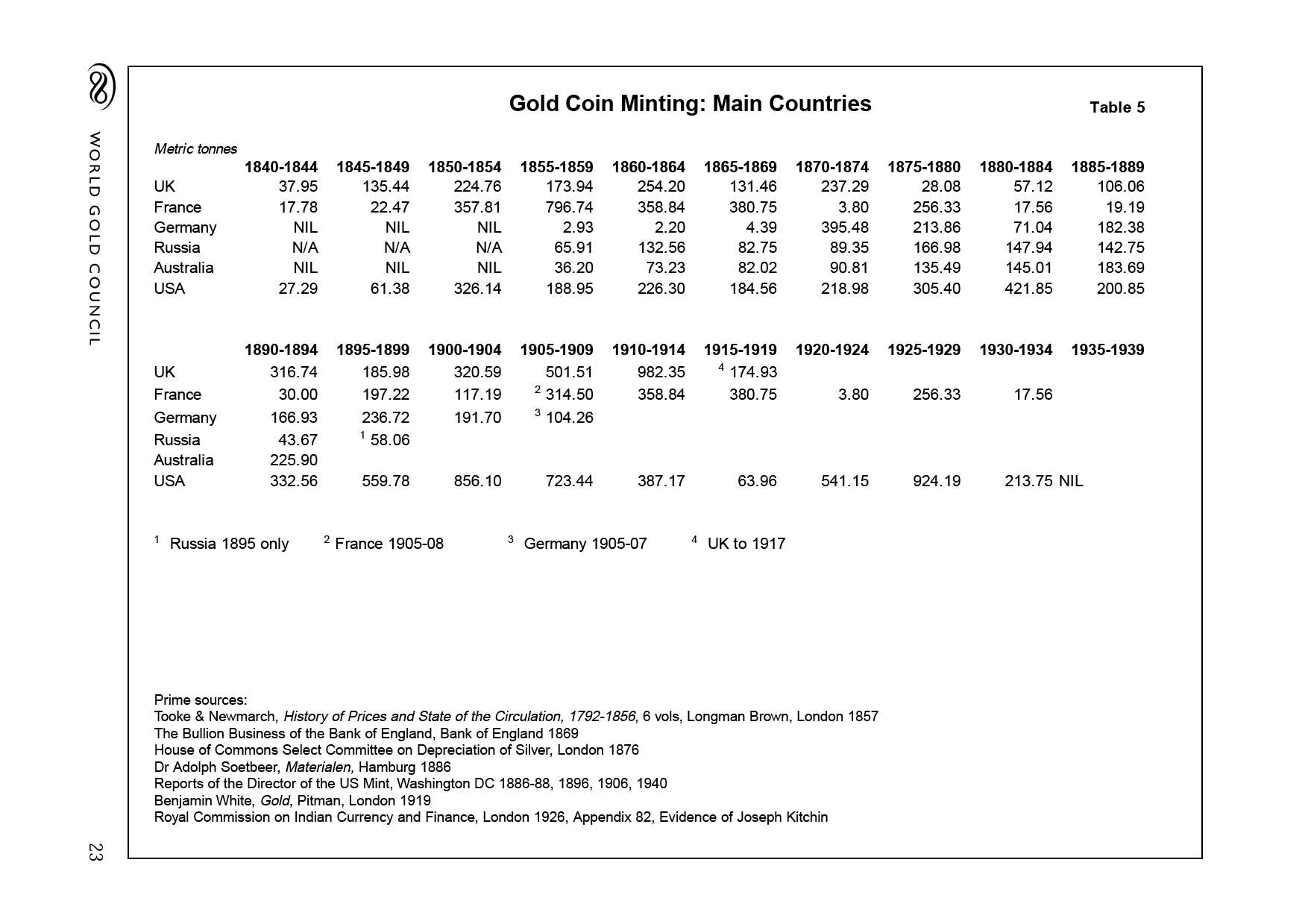

Table 5 Six Countries Gold Coins Minted 1840 - 1934 (UK, France, Germany, Russia, Australia, USA)

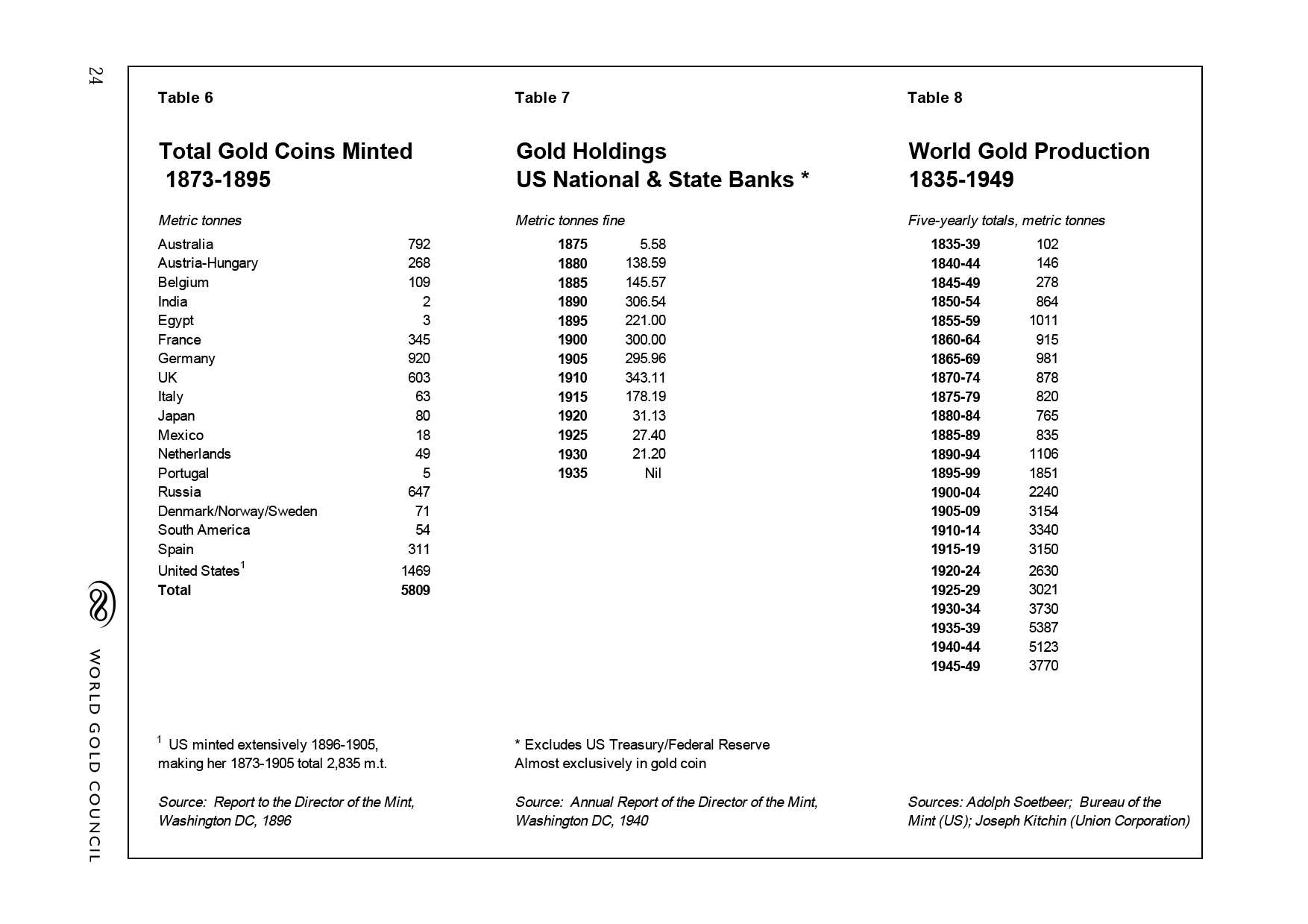

Table 6 Gold Coins Minted (by all countries) 1873 - 1895

Table 7 Gold Holdings in US Banks 1875 - 1935

Table 8 Gold Production Totals 1835 - 1949

As another sidenote, Table 4 below shows the major increases to the gold reserves stored in London and New York, Moscow and Paris that took place on the dawn of World War 2. USSR gold reserves which had been 7456 metric tonnes in 1935 and second only to the US, increased by another 510 metric tonnes in 1936 as a result of the

Spain and the USSR had this in common at the outbreak of World War 2, neither reported their holdings to

However at the end of World War 2, the USSR holdings appear to have also become negligible, with much of the gold apparently ending up on deposit in the US.

** End of Report