Intro.

Lira Livre and Libra — books, Pfund and Pound — weight, Florence and Florins, and Francs — freedom

In Italy, Lira (or Libra) Soldo and Denaro were the old Roman units of account, with one libra always equaling 20 soldi or 240 denari, corresponding to the Livre Sol (Sou) and Denier in France, Pound shillings and pennies (£ s d) in England, and Pfund and Pfennig in Germany. Note that Soldo, Denaro, Denier, Pennies and Pfennig represented silver coins, all the other terms represented their paper (book) value. The Soldo's name came from an old gold coin called the Solidus, weighing 24 carats or about 4½ grams, issued in ancient Rome and Constantinople to the military, their "soldiers".

Click here for the history of money, silver and gold, in scripture.

Following Constantinople's **decline in the face of Turkish, Venetian and Mongol expansionism, new gold coins were issued from Florence, starting in 1252, worth one Florentine Lira in book value. The "Florin" coin itself contained 3½ grams of gold. In silver it was worth 20 soldi in Milan in Italy, about 10 sols (120 denier) in France, about 2 shillings (24 pennies) in England, and about 32 pfennigs in Cologne in Germany that contained 35 grams of silver, an initial value of gold-to-silver of 10 to one. It weighed slightly less than the Arabic Dinar, and as an international currency it replaced the Spanish Maravedi (in the west), whose gold content had fallen to one gram, in fact it was about to be reissued in silver as a result of their wars, click here for an account. And a rapid devaluing of soldi, denier and pfennigs in Italy France and Germany as more and more copper were added, meant that by 1500 in Florence, the gold florin was worth seven paper lire.

See the Florentine graph at the bottom showing this trend between the years 1260-1780.

** In the east, in the "Great Fire" of 1204, a large part of Constantinople was burned down. It was caused by a riot of Venetian soldiers and sailors, led by their unscrupulous doge Enrico Dandolo, on the so-called "Fourth Crusade".

Three gold coins of similar weight were the Ducat, issued by the Doge in Venice, the gold Penny (initially worth 20 pennyweight or one ounce of silver), issued by King Henry III in England, and the gold Ecu

In 1323, new gold mines were opened in Hungary north of Budapest, allowing the government to issue their version of the gold Florin, the Hungarian Forint. For 50 years or so, these mines actually supplied almost 80% of Europe's gold production.

A heavier coin, a gold Noble, was issued in England early in 1344 with a weight of 9 grams. The Noble was valued at three florins (six shillings). The silver penny now contained about 1.3 grams and a value of gold-to-silver of about 10.4 to one. But gold was now seen as being undervalued, and a second issue that year increased the Noble to 6s 8d — then a third issue in 1346 reduced the gold to 8.3 grams — and finally a fourth issue in 1351 stabilized its weight (for over 100 years) at 7.8 grams, and a value of gold-to-silver of about 13.33 to one.

The trade weight for silver of 2 gold Nobles (13s 4d) was 8 tower ounces (about 233.856 grams), ⅔ of the weight of the 12 ounce London tower pound. That was the value of the Cologne Mark (half a German Pfund of 16 tower ounces) as employed by the Hanseatic League in maritime trade throughout north-western and central Europe.

In 1360 over in France, the gold Ecu of 3.75 grams, now worth 240 silver deniers or one livre Tournois, became known as the "Franc", paying for "freedom" for the French king, held prisoner by King Edward III in England in the midst of the French-English

In 1412, the level of silver in the penny dropped to just 1 gram and the value of gold-to-silver dropped to about 10.25 to one. In 1464, during the Wars of the Roses, this was rectified with a new issue — the

Shortly after, the Royal was discontinued, and in 1489 the Sovereign (or double Royal), worth 20 shillings and weighing 15.55 grams (one half of a troy ounce), was issued at 23 carat (95.83% fine). Click here for notes on Troy Weights and Carats.

In September 1717 the gold price was fixed by Sir Isaac Newton, master of the Royal Mint in London, at £4.4s.11½d per troy ounce of fine gold (at 24ct 99.9% purity) or £3.17s.10½d (at 22ct 91.66% purity), a value of gold-to-silver of 15.2255 to one. It fixed the gold guinea coin, fine weight just under a ¼ ounce, at 21 shillings from gold's market price of 21s.6d.

Click here to see the "Gold Standard Act" as it was enacted in the US in 1900, previously "de facto" and now "de jure" (by law), when the Congress passed its definition in relationship to the dollar.

In 1524, the Holy Roman Emperor Charles V declared the Cologne Mark at 8 tower ounces (233.856 grams) to become the standard weight of all precious metals on the continent (and elsewhere). It was close to the weight in sterling silver of 240 English pennies in 1489, and the value of King Henry VII's £1 gold Sovereign.

Accordingly in 1566, the Reichstaler coin was set at the Leipzig Convention for issue employing one-ninth of a Cologne Mark of fine silver (25.984 grams).

The Peso (Piece of eight reales) having 25.56 grams of fine silver was issued in Spain, then in the mints of Mexico and Peru, corresponding to this German and Austrian "Thaler". It became known in the English language as the Dollar, a name that spread throughout Asia, as traders using Russian Rubles, Indian Rupees (11½ grams fine silver), Thai Baht (13½ grams fine silver), later the Japanese Yen in 1871 and Chinese Yuan in 1889 (at 24 grams fine silver) all started pegging their currencies to this Peso, this Dollar.

Following the Bavarian Monetary convention of 1751, it was reduced to the Conventionsthaler of one-tenth of a Cologne mark of fine silver (23.39 grams). Its most famous example today is probably the Austrian coin the

In 1933, US President Franklin Roosevelt ordered that all holdings of gold certificates, gold coins and gold bullion in excess of 160 grams per individual had to be deposited with the US Federal Reserve at Fort Knox at $20.67 per troy ounce accepting US dollar banknotes (like deposit slips) in their place. Only rare and unusual coin collections were exempt, along with special needs businesses e.g. dentists, artists, jewellers. Domestically until 1968 the US was on the silver standard, $US1.29 per troy ounce.

In 1934 the US government devalued its currency in terms of gold to $US35 per troy ounce, a new value of gold-to-silver of 27 to one. By October 1941 and WW2 the Federal Reserve had become the world's largest central bank with 20,000 tonnes of gold and 80% of global reserves.

As US gold stocks diminished after 1950, Fort Knox dropping to 4,500 tons, to prevent it from "emptying" on August 15 1971 the US Government suspended the convertibility of the US dollar to gold, causing it to freely float on currency markets.

It was followed in Europe by the setting up of a composite artificial currency unit called the EUA in 1975, followed by the ECU in 1979, and then the Euro on January 1st 1999 when many European central banks converted over their currencies. Click here for some notes.

Since 1999, all foreign exchange trade is monitored by the Bank for International Settlements. Based in Basel in Switzerland, it is an institution owned by 62 central banks and monetary authorities. It started by intergovernmental agreement in 1930, initially trading in gold Francs, set up to assist the German government with its WW1 reparations. After September 1939 it acted as a neutral central bank, providing significant back-channel communications between the Allied and Axis powers. It survived WW2, though Walther Funk a director in 1939 was imprisoned in 1946 as a war criminal.

After the war it worked closely with the UN's IMF International Monetary Fund, assisting central banks in Europe and Japan, and it has become the global bank for all the major central banks.

In 2026, all currencies are valued in terms of US dollar eg

US Dollar's worldwide ownership in Treasury bonds/notes/bills $38 trillion.

Australia from its early British settlement in 1788

France, Belgium and Switzerland

Germany, the Austro-Hungarian Empire, and the Dutch Netherlands

United States, Mexico and Canada

Click here for the following Middle East currencies: Egypt, Lebanon, Syria, Jordan, Saudi Arabia, Iraq and Iran, plus Balkan Serbia and Albania, also Ethiopia, Nigeria and South Africa.

Click here for the following Asian currencies and their recent USD exchange history Australia, Bangladesh, Korea Sth & Nth, Malaysia, Myanmar, New Zealand, Pakistan, Papua New Guinea, Philippines, Singapore, Thailand and Vietnam.

Go top to read about France's earlier coins.

In 1577 King Henry III issued a new silver franc coin of about 14 grams. He also reissued the gold Ecu coin weighing 3.2 grams but now worth 3 livres (or francs) a value of gold-to-silver of about 13 to one.

In 1641

In 1795 the Franc was decimalized at 100 copper centimes (cents) with 4½ grams of silver or 290.034 milligrams of fine gold a value of gold-to-silver of 15½ to one at roughly 20 US cents, 10d in England.

In 1865, France formed a Latin Monetary Union with Italy Belgium Switzerland until WW1. In WW2, the franc was heavily devalued. In 1960 it was replaced by the "new" franc at an exchange rate of 100 to 1. In 1999 France converted to euro, at 6.56 francs to the euro.

In 1999 Belgium converted at 40.3399 francs to the euro.

Switzerland has kept the franc, in 2026 valued at $1.29.

Following its wars of independence from the Turkish Ottoman Empire, and with assistance from other governments, in 1832 the Greek government issued the drachma as a silver coin similar to the Franc, with 4½ grams of silver.

After WW1, and following 3 years of an expensive war brought on by Greece's occupation of part of Western Turkey (but places where many Greeks lived), and with Greece's subsequent retreat, in 1922 the Greek government insisted every drachma note be cut in half. The left half became half-value, and the right half was replaced by a 20 year interest bearing bond from the government. When the government did this again in 1926, the popularity of drachma paper, already low, dropped again with many people refusing to accept notes unless they could be exchanged as quickly as possible.

With huge hyperinflation that followed the Nazi invasion 1941-1944, this paper drachma was replaced by a new drachma following Greece's liberation in November 1944, at a ratio of 50 billion old drachma to the new drachma. This occurred again in 1954, though at a lower level, with a ratio of 1000 of this second drachma to another new drachma. This third drachma was then, for a time, pegged to the US dollar at a ratio of thirty to one.

Finally in 2002, the drachma changed to the euro, using a conversion rate of 340.75 drachma to the euro.

In Sardinia Italy, the 4½ gram silver Lira coin was issued in 1816, similar to the Franc, with 4½ grams of silver. Through World Wars 1 and 2, though, as happened to the Franc in France, the lira was massively devalued. In 1999 Italy changed to the euro using a conversion rate of 1936.27 lire to the euro.

But firstly, Amsterdam, the Royal city and since 1814, the Capital city in the Netherlands

The origins of the Dutch split between The Hague as seat of government and Amsterdam as capital city lay in its peculiar constitutional history. From the middle-ages to the sixteenth century, The Hague had been the seat of government of the County of Holland, but Amsterdam was the more important city. When the Dutch provinces formed an independent republic during the Eighty Years War (1568-1648), Amsterdam actually remained loyal to the Spanish/Burgundian empire until relatively late in that war. This allowed the city a lot of trade opportunities, but made it unsuitable for the seat of government of an emerging 'rebel' state.

In 1602 in the newly opened Bank of Amsterdam, the German Reichsthaler could be exchanged for 2½ Dutch Guilders, a small gold coin containing 605.61 milligrams fine, or a silver coin of 10.61 grams 91% fine, a value gold-to-silver of almost 16 to 1, like the franc and the florin. The bank, with its banknotes issued for a small fee, was administered by a committee of city government officials that kept its affairs secret. It initially operated on a deposit-only basis, but soon it was allowing depositors to overdraw their accounts, lending large sums to the Municipality of Amsterdam and to the United East Indies Company (Dutch East India Company). All this, eventually, became public knowledge. In 1790, and the French Revolution, the fee (called an agio) on the bank's paper money had dropped from its premium at peak of around 6.25% to a discount of 2%. By the end of the year the bank had to declare itself insolvent, offering to sell its silver at 10% discount. The City of Amsterdam took over direct control in 1791, finally closing the bank in 1819.

Between 1810 and 1814, the Netherlands was annexed to France and the franc. After the Napoleonic wars, the Kingdom of the Netherlands readopted the Guilder. With gold shortages, in 1848 the gold coin was suspended. In 1875 the Netherlands reissued it at 604.8 milligrams fine, suspended it again between 1914 to 1925 and abandoned it in 1936.

In 1961 the silver guilder was revalued at 3.62 guilders to the US dollar, similar to the German Deutschmark. After 1967 guilders were made from nickel instead of silver. In 2002 the guilder was replaced by the euro at an exchange rate of 2.20371 guilders to the Euro.

Germany

In 1750 the German state of Prussia adopted the "three shilling" Reichsthaler of 16.704 grams, and replaced it in 1857 by the Vereinsthaler ("Union Thaler") of 16.666 grams, being worth exactly 1½ Austrian Gulden, Hungarian Forint or English Florins.

With Germany's unification in 1871 under Prussia, the "one shilling" Gold Mark at 358 milligrams of gold and one third of a Vereinsthaler, was decimalized as 100 pfennig. Due to a shortage of gold and silver, a Papiermark issued during WW1 was replaced by a temporary Rentenmark in 1923 and by the Reichsmark in 1924 at a ratio of one trillion Papiermarks to the Reichsmark.

After WW2, for a maximum of 60 Reichsmarks per person, the Deutsche Mark was issued (in 1948) at a ratio to the Reichsmark of 1:1. This Deutsche Mark, initially valued at 30 US cents, was printed by a new Central Bank (Bundesbank) in Frankfurt that also monetized all private (non-government) debt at a ratio of 10 Reichsmarks to the Deutsche Mark. Half of this amount initially remained out of reach in a blocked account, with 70% of the blocked amount subsequently cancelled, later that year.

In 1999 Germany changed to the euro at a conversion rate of 1.95583 Deutsche Marks to the euro.

The Austro-Hungarian Empire

In 1754 Austria issued the Gulden that was worth half a Conventionsthaler, a silver coin of 11.695 grams, called a Forint in Hungary and again similar to the Dutch Guilder and English Florin. In 1857 it was reduced to 11.111 grams in preparation for a closer union with Germany, at exactly two-thirds of their "three shilling" Vereinsthaler ("Union Thaler").

Next in 1892 the Gulden was replaced with the Krone ("Crown") at a ratio of 2 Kronen per Gulden, but devalued to 85% of the German Mark, and 75% of the Scandinavian Krone that had been recently introduced in Denmark Norway and Sweden.

Following the hyperinflation of WW1 and the breakup of the Empire, the Kingdom of Hungary was created in 1920.

In 1923 the Schilling was issued in Austria at 10,000 Kronen to the Schilling. In 1927 the Pengo was issued in Hungary at 12,500 Korona (Kronen) to the Pengo.

Following the invasion of Germany in 1938, the Austrian Schilling was replaced by the Reichsmark at a ratio of 3 Schillings for 2 Reichsmarks. The Kingdom of Hungary was "awarded" lands that it had lost in 1920, and allowed to retain its Pengo.

In 1945, the Austrian Schilling was reissued at a ratio to the Reichsmark of 1:1, though at a maximum of 150 Schillings per person. This happened again in 1947 with a second issue of Schillings, a maximum of 150 new Schillings per person, but also an exchange of 3 old Austrian Schillings (pre-1938) for 1 new Schilling. In 1946, the Hungarian Forint was reissued at 4 x 1029 Pengo to the Forint.

In 2002 Austria changed to the euro, at a conversion rate of 13.7603 schillings to the euro. Hungary continues to use the forint, valued at 390 - 400 forint to the euro.

About 1350 a small silver coin called a Reale was issued, weighing 3½ grams and valued at 3 Maravedis, their previous debased coinage.

In 1497 the Peso (Piece of eight reales) having 25.56 grams of fine silver was issued in Spain, later also in Mexico and Peru.

In 1537 the gold Escudo (shield) was issued with about 3.43 grams of gold and valued at two Spanish Pesos, also the Doubloon (Double Escudo) valued at 4 Pesos.

From the 1600s, the level of silver in the Peso coin minted in Spain was steadily reduced. The takeover of Spain by Napoleon's brother Joseph in 1808, followed by the loss of Mexico and Peru, resulted in French coinage entering domestic circulation.

In 1869 the Peso was replaced by the Peseta, similar to the franc with 4½ grams of silver. The silver disappeared altogether in 1910. In 2002 Spain changed to the euro, at a conversion rate of 166.386 pesetas to the euro.

In 1179 King Afonso adopted as the currency of Portugal the small Dinheiro coin, at 12 dinheiros per soldo, made of billon (silver and mostly copper). It was used until 1433. King Sancho I (1185-1211) introduced the gold Morabitino, from the Spanish Maravedi (about 3½ grams of gold), and equivalent to 180 dinheiros.

In 1380 King Ferdinand I introduced the silver Real weighing about 3½ grams, worth 120 dinheiros and equivalent to a Spanish Reale. Note, the plural of real (ray-al) in Portuguese is reis (ray-is). Its silver content steadily diminished.

In 1452 under King Afonso V (known as the African) the Portuguese treasury minted their first gold Cruzado coins at 3.78 grams now worth 400 reis, as the king tried to organize a crusade against the fall of Constantinople by the Turks, that occurred soon after in 1453. The Cruzado became the equivalent, in international trade, to two Spanish Pesos (or Dollars) with their introduction in 1497.

Under King Joao II (1477-1495) the silver Cruzado followed at 22.9 grams 91.7% fine, slightly less than a Spanish Peso. The government started minting real coins in copper only.

On May 22 1911, after the 1910 Portuguese Republican revolution, the real was replaced by the escudo at 1000 reis to the escudo. The escudo, which had been issued as a gold coin of 1.62585 grams in 1854, was now a silver coin, and then a cupro-nickel coin after 1927.

The euro was introduced into Portugal on January 1st 1999, replacing the escudo at the ratio of 200.482 escudos to the euro.

Portugal settled Brazil in the 1500s, introducing the Portuguese real. In 1806, a 640 real silver coin was issued at 17.92 grams, 91.7% fine. The real's value fell rapidly after Brazil became a republic in 1889. In 1933 it was valued at 12,500 to the dollar, in 1939 22,500.

In 1942 a new coin the cruzeiro, worth 1000 reis was issued. In 1967 it was replaced by the second cruzeiro worth 1000 of the old. In 1986, 1989, and 1993 there were three further issues at 1000 to 1, finally stabilizing in 1994 with its current real at 2750 to 1, or 2.75 trillion cruzeiros prior to 1986. At the time, the real was close to par with the US dollar. Currently it is worth 19 cents.

In 1704, Peter the Great issued the Russian Ruble coin with 28 grams of silver, worth 100 copper Kopeks. By the mid-1800s it was down to 12 grams. After the revolutions in Russia (in 1917) and China (in 1949), and in unsettled times, the value of their paper currency was officially set to unrealistic high values. Only a few international trading companies were established, covering the higher cost of imports by an exclusive edge outside the country on exports, helping to keep domestic prices under control. Also a "black market" (unofficial market) thrived for people prepared to sell the domestic currencies to foreigners at lower rates. In fact, after 1961 Russia officially set the value of the ruble higher than the US dollar. China, following the second issue of the renminbi yuan in 1955, a little more realistically fixed its value at 40.65 US cents.

Russia: Click here for official exchange rates from 1993

After the Russian Revolution in 1917, there were several issues of the Soviet Ruble:

After the breakup of the Soviet Union in Dec 1991, starting with the fall of the Berlin wall in 1989 and the reunification of Germany in 1990, Russian ruble banknotes in 1992 issued 1:1.

The ruble's exchange rate versus the US dollar depreciated significantly from US$1 = 125 RUR in July 1992 to approximately US$1 = 6,000 RUR on 1st January 1998 when the currency was redenominated at 1000:1. In 1999 it fell to 4 cents, in 2009 to 3 cents, in Nov 2014 to 2 cents, and in Jan 2015 to 1½ cents.

Ukraine from November 1990 issued ruble coupons, replaced In September 1996 by the hryvnia (huh-riv-nyuh) 100,000:1. Currently worth 2 cents.

China: Click here for its monthly exchange rates from 1960. Following World War 2, the gold yuan (worth about 30 US cents) was issued in Shanghai in August 1948 in exchange for 3 million wartime yuan. But with prices increasing 10-fold monthly, the People's Bank in Beijing, founded December 1948, issued their yuan, worth 100,000 of the Gold yuan. In 1955 a second yuan was issued, worth 10,000 of the first, at 40.65 US cents.

When the US floated the dollar in 1971, the Chinese government caused the official value of the yuan to increase, until by 1980 it was valued at 65 US cents. In 1979 the Chinese government established a subsidised export price for the yuan at 35 US cents which significantly increased their market share of exports to the US and elsewhere.

This dual track pricing lasted for 15 years, with the two rates dropping steadily. In 1994 the two prices were united at the export price of 12 US cents. This price then lasted until 2005, each year enabling a surplus in China's current account (exports exceeding imports) with the government building up significant stocks of gold and US bonds. Since then the government has allowed the yuan to increase in value a little. The yuan is currently priced at 14 US cents.

Taiwan: Click here for its monthly exchange rates from 2000. Taiwan was occupied by Japan from 1895 and the yen was their official currency. It was at par with the mainland's yuan and worth $US0.50. In 1946 after the Japanese troops left, the Bank of Taiwan issued the Taiwan dollar at par with the yen. Hyperinflation on the mainland meant this dollar's value also depreciated rapidly.

After the Communist capture of Beijing in January 1949 by Mao Zedong, the old mainland government, led by Chiang Kai Shek, sent China's gold reserves to Taiwan in February before Chiang's arrival in December. The New Taiwan dollar was issued that year by the Bank of Taiwan in June, exchanging 40,000 old Taiwan dollars for each new one. The Bank of Taiwan became the defacto central bank for Chiang Kai Shek's government in Taiwan.

In July 1949 the central bank also issued the Silver yuan in exchange for 100 million Gold yuan, valued at 30 US cents, or three New Taiwan dollars. However it was nearly impossible to buy sell or use it, so it did not exist in front of the public. Still, many old statutes had fines and fees given in Silver yuan.

In the 1960's, the value of the NT$ dropped from 10 US cents to 2½ US cents, enabling a strong export market to grow. For the Taiwan government, it meant an increase in its reserves of US currency.

In 2000, the Central Bank (Taiwan) replaced the Bank of Taiwan in issuing NT$ bills. It is currently valued at 3 US cents.

Hong Kong: Click here for its monthly exchange rates from 1953. Their British silver dollar was issued at par with the US and Spanish Mexican dollar in 1863, with a UK value of four shillings and twopence. In 1935 it decoupled from its silver standard, dropping to a UK value of one shilling and threepence.

Since 1972, it has been pegged to the US dollar. Currently it is overseen by the

It is currently valued at $0.13 US cents.

In 1871, Japan issued the Yen silver coin with 24.26 grams of fine silver, pegged to the US Dollar in terms of trade. In 1884, the Bank of Japan was granted a monopoly by its government in issuing paper banknotes. In 1897 Japan adopted a gold exchange standard, with the silver Yen's devaluing to $US0.50. It remained at this rate through Japan's annexation of Korea in 1910, in its war with Communist Russia 1918-1922, right up to its invasion of Manchuria in 1931. Following some upheaval, the Yen dropped in value to $US0.30 with no clear exchange rate issued after 1941 and Japan's entering WW2.

At the close of the war in 1945, Japan was occupied by the US army for seven years to assist with the rebuilding of its economy and as a bulwark against Russian expansionism. Between 1947 and 1949, approximately 5,800,000 acres (23,000 km2) of land (approximately 38% of Japan's cultivated land) were purchased from landlords under the government's reform program and resold at extremely low prices (after inflation) to the farmers who worked them. By 1950, three million peasants had acquired land, dismantling a power structure that the landlords had long dominated.

On April 25 1949 the US occupation government fixed the value of the yen at ¥360 per US$1. During the next post war years, the Japanese government maintained a steady surplus in its current account (exports exceeding imports) enabling its government bonds to become a safe haven for investors.

After the US government floated the dollar in 1971, the Japanese government, carefully, did likewise with the yen, and it steadily increased in value on the open market. By 1995, it had increased over 400% to ¥80 per US$1. Since that time the government has pursued a policy of zero to negative interest rates, causing land prices, in fact many prices to plunge as investors search for other "safe haven" investment opportunities. Today the value of the yen is about ¥150 per US$1.

The Indian rupee historically contained about 11½ grams of fine silver (and was worth about two English shillings). However, like the devalued yuan, ruble, and yen, traders could insist on the coin being at parity with the dollar (i.e. about 4s.2d).

Early in 1942, the Japanese invaded the Dutch East Indies, taking control of the whole country by March. On their invasion ships, they brought their own issue of the local money, the Dutch gulden. Massive overprinting of this paper resulted in hyperinflation. The Japanese money continued to circulate after the war, as Indonesia prepared for independence, also with many towns printing their own currency.

In November 1949, Indonesia was granted independence from the Netherlands with their new currency, the rupiah.

In 1965 the "new" rupiah was introduced at 1000:1 of the "old" rupiyah, and in 1967 valued at 150 to the dollar. Inflation surged to 10,000 to the dollar by 1998.

In 2026, the rupiah is valued at 16,000 to the dollar.

Go top to read about England's earlier coins.

In England in 1489, King Henry VII issued a large gold coin, the English Sovereign, weighing 15.55 grams and minted in 23 carat i.e. 95.83% fine. It was valued at £1 sterling, 20 shillings of 12 heavy pennies of 1 gram of silver, 240 grams at 92.5% fine a gold-to-silver value of 14.9 to one. King Henry VIII lessened it to 22 carat i.e. 91.67% fine. His Great Debasement in 1544-1551 reduced precious metal in new silver coins by as much as 80%. Not fixed until Queen Elizabeth I.

Thus Henry VII's gold Sovereign, an international standard, increased in value to 30 shillings by 1558 until discontinued in 1604 in the reign of King James I. The 5.2 grams gold English coin called an

In 1663 it was replaced with the 8.385 grams Guinea coin (7.688 grams fine) a gold-to-silver value of 14.44 to one with all silver coins now milled to prevent clipping.

In 1694 the Bank of England opened, issuing banknotes. In 1696 non-milled coins were demonetized, payable only as taxes at 5s.8d per ounce (31 grams). The Guinea rose from 20 to 30 shillings, and back to 21s.6d at the reign of King George I.

The Gold Standard: In 1717, under Sir Isaac Newton, "master" of the Royal Mint, the shilling's value was "fixed" by Parliament with the guinea set at 21/- a gold-to-silver value of 15.2255 to one. A law of government guaranteed exchange in silver or gold, it made the Bank of England a bankers' bank.

In 1817 after the wars with France, the silver shilling coin was reduced to 5.65 grams of sterling silver a value of gold-to-silver of 14.28 to one. The Sovereign £1 gold coin was issued, worth 20 shillings. It weighed 7.988 grams (7.325 grams fine).

In 1917 minting ceased in London during WW1, followed by the branches: Bombay 1918, Ottawa 1919, Sydney 1926, Melbourne and Perth 1931, Pretoria 1932. Minting restarted in London in 1957, though mostly for collectors. While in 1933, the world's largest "bankers' bank" shifted to the USA, with their opening of Fort Knox.

In 1949, the British government devalued the £1 note by 30% to $US2.80, previously it had been valued at $US4.03 (and before 1940, at about $US4.80). After 1967 it was devalued to $US2.40, then after the US floated the dollar in 1971, the £1 also floated up and down on international exchange markets (click here for a graph) at around the $US1.50 mark. Currently in 2026 it is valued at about $US1.35, or about 1.14 Euro.

Turkey: The Kurus was introduced to the Ottoman Empire in 1688. It was initially a large silver coin, approximately equal to the French Ecu or the Dollar. Referred to as a Piastre in Cyprus and Egypt, based on the Spanish Peso. During the 18th and early 19th centuries, debasement reduced it to a billon (i.e. mostly copper) coin weighing less than 3 grams, and valued at 100 to the English £.

In 1844 the Ottoman gold Lira coin and banknote were introduced, worth 100 kurus (piastres) with 1 Lira = 6.61519 grams fine gold or 99.8292 grams fine silver. Following World War I, Turkey's gold Lira coin took on an exchange value of about nine Lira in paper banknotes. With a new Turkish republic in 1923 and a gradual formation of a new central bank, there were numerous bankruptcies as much of the previous government's high foreign debt was apparently frozen until after WW2. Click here for more details. In 1946 the lira was officially devalued to one tenth of its previous value, from 0.28 lira to the dollar to 2.8 lira to the dollar. In 1960 it became 9 to the dollar, in 1980 90 to the dollar, 1988 1,300 to the dollar, 1995 45,000 to the dollar, 2005 (at the start of Mr Erdogan's government) 1,290,000 to the dollar. In 2005 the new lira was introduced, worth one million of the old lira. In 2026 this lira held an exchange value of about 2 US cents.

Palestine, Gaza Strip and Israel: Over in Palestine, following the institution of the British Mandate in 1917, the Egyptian pound note, pegged to 97½% of the British pound sterling, circulated alongside that devalued Turkish Lira. In 1927 the Palestine pound, worth 1000 mils, was introduced by the British as a new currency at par with the British pound sterling.

With the establishment of the State of Israel in 1948, printing of these pound notes (called lira Eretz-Yisraelit) came from the Anglo-Palestine Bank, a bank that had been established in 1902. In 1952 the bank changed its name to the Israel National Bank (Bank Leumi Le-Yisrael) and the official currency became the Israeli pound (lira Yisraelit) having as a symbol I£. West Bank changed its currency to the Jordanian Dinar, Gaza had already converted to the Egyptian Pound in 1951.

In 1954 the pegging to the British pound note was dropped, and in 1955 the Bank of Israel issued banknotes with the Israeli pound valued at 55 US cents.

After the 1967 six day war, both Gaza and West Bank switched their currencies to the Israeli pound, now about 32 cents. By 1970 it was 28 cents, by 1980 1.9 cents.

On 24 February 1980, the pound was replaced by the shekel at a ratio of 10 pounds to the shekel, about 19 cents.

After the Lebanon war with the PLO 1982-1985, on 1st January 1986 the shekel was replaced by the "New Shekel" at 1000:1, with a new value of 67 cents.

In 2026 the New Shekel held an exchange value of about 32 cents.

Click here for further statistics and notes on using Bitcoin. For stability, its "mining" difficulty restricts it to about one block of "confirmation" transactions added to the blockchain every 10 minutes, averaging in 2025, 5 transactions per second. The maximum size for a block is about one megabyte, with an eventual "miner" earning a small commission in new bitcoins. So technically it is more like a specialist peer-to-peer Internet bank than a serious currency, as sellers have to "outbid" other users (by offering additional bitcoin commissions to miners) in order to take precedence in its transaction "mempool" queue. In August 2017, a new currency, based on Bitcoin but with a larger block size (called "Bitcoin Cash") was launched.

But here is some of Bitcoin's background. Note, bitcoins themselves can be broken down to 8 decimal places.

In 2009 the source code for its technology was published. Initially, it held zero or minimal value. Mining started in January 2009, issuing a 50 bitcoin transaction to each successful miner every 10 minutes, though often with no other transactions in the block. Just over 2½ million bitcoins were added annually during those first 4 years. During 2009 about one dozen people were thought to be involved, increasing to 30 - 80 people in early 2010.

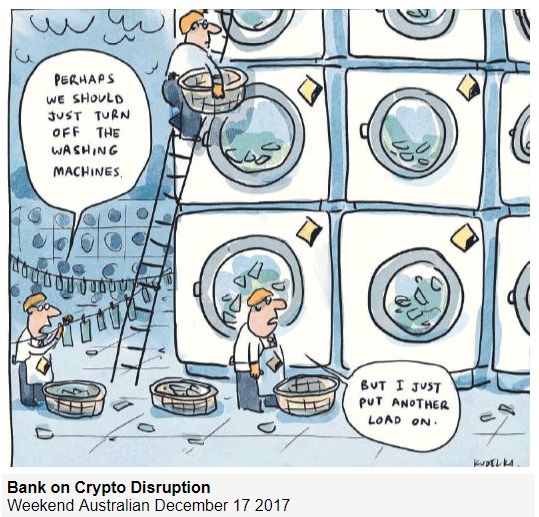

When Mt. Gox Currency Exchange opened in Tokyo in July 2010, thousands became involved, and its value increased from seven cents to $1.00 in February 2011. After money laundering, drugs, and other criminal activities became available via the Silk Road's darknet web site that month, its market value accelerated.

During 2013, Mt Gox handled about 70% of all Bitcoin currency trading.

Click here for its price timeline history.

Click here for an interview with a man thought its inventor.

In 2026 there are roughly 24,000 "reachable" nodes, each with their own copy of the full Bitcoin master file, about 700 gigabytes in size. There are now ca 19.9 million bitcoins on issue, total value around $US 1 trillion (about $67,000 per bitcoin) as a result of supply and demand.

Bitcoin transactions are associated with four codes — 1) an old public key and signature, both generated automatically by 2) the old owner's private key and 3) a new public key, generated automatically by 4) the new owner's private key.

These private keys are 256 bit long encryption keys, formed using a random number generator inside the Bitcoin program. They are stored in wallet files on your computer or at a custodial broker exchange, along with public keys and corresponding addresses. The length of the owner's private key provides for 1077 power in variations, and is designed to protect owners from a brute force attack by hackers. Click here for comments. Tens of millions of bitcoin wallets are estimated to be in active use.

When transferring bitcoins, the transferor uses their private key to input a signature code — 568bits, 576bits or 584bits long — confirming the transferor's ownership of one (or more) earlier transactions, by each signature's ability to validate the public key found at an earlier transaction address. The transferee's private key(s) specify the new public key(s) together with its number of transferred bitcoins, and the transferor creates a record for any balance. All are validated and stored on the master file in the next available block. Click here to read more about how transactions work.

So, if the new owner's private key is stolen, so probably are the coins relating to that bitcoin transaction. If the private key is lost, so are the bitcoins.

Since April 20, 2024 there are 3.125 bitcoins in a commission every 10 minutes. It had started as 50 bitcoins in Jan 2009. At 210,000 blocks and 10.5 million bitcoins in Nov 2012, it halved to 25. At 420,000 blocks and 15.75 million bitcoins in Jul 2016 it became 12.5, in May 2020 6.25.

Mining pools involve tens of thousands of specialist computers seeking to earn the commission by publishing a block. Each block contains a timestamp and hash pointer linking to the previous block, forming a "blockchain". "Success" is awarded by the mining pool first solving a difficult randomised mathematical problem, then having the longest chain i.e. the most combined data if two miners arrive at a solution for the same block simultaneously on different nodes. One block will thus be "accepted", the other is "orphaned". Once a block is accepted by 51% of the nodes, it is inherently secure.

No Rollback. Once your bitcoins are mined, there's no way to "freeze" a transaction, or undo it, like with Paypal or on centralized mainframes. All that is seen is the transaction address of the new record they were sent to. It is this anonymity that is their greatest attraction (and danger). Click for an input / output Transaction example.

The Dollar was officially adopted in 1785, divided into 100 units at 2 copper cents per English Penny. Based on the Spanish Dollar of 8 reales/ bits, in 1794 its dollar coin was issued with 24.056 grams fine silver ($1.29 per troy ounce 31.103 grams). In 1795 the $10 gold Eagle coin was issued with 16.05 grams of fine gold, a value of gold-to-silver of 15 to one. Other coins were the quarter (25 cents or 2 bits), dime (10 cents), silver half-dime (5 cents), and 1 cent and ½ cent copper coins.

from the bank). In 1811, its assets were liquidated, to become the Girard Bank.

from the bank). In 1811, its assets were liquidated, to become the Girard Bank.

But inflation due to conveyancing was widespread. Banks acting as escrow agents, arranged contracts with buyers then issued private bank notes to the federal government in exchange for deeds of title (ownership). In one article, lands that sold for $4,800,000 in 1834, sold for $14,700,000 in 1835, then for $24,800,000 in 1836. Cotton prices rose from 11 cents a pound to 16 cents a pound in 1835, though it dropped in 1836. Not only was the United States out of debt, but largely through the public domain was piling up a surplus in her treasury. Land speculators organized a "bank", got it appointed a deposit bank if they could, issued notes, borrowed them and bought land. The notes were deposited, they borrowed them again, and so on … and so on.

The Crash

In September 1833 President Jackson had removed all federal deposits from the Bank of the US. In February 1836 it became a private corporation again under Pennsylvania law. That July President Jackson ordered the Secretary of the Treasury to issue the "Specie Circular"--under federal law the government refused to take anything but gold and silver specie for sales of public lands of over 320 acres after August 15, while legitimate settlers (non-speculators, those purchasing plots of 320 acres or less) were allowed to use paper until December 15.

No national bank to regulate fiscal matters and shortage of hard currency saw the

From 1837 to 1844 deflation in wages and prices was widespread. Major recovery only really arrived in 1848 with the discovery of gold in California, followed by "National" banks re-emerging 1863-1913.

Gold Certificates Nov 1865 - March 1933 and Silver Certificates Feb 1878 - June 1968

Gold Certificates initially $20, $100 and higher (up to $10,000) meant one could deposit gold at the Treasury and receive a gold-backed Certificate in exchange. It enabled the Government Treasury to accumulate gold reserves, while the notes became popular with merchants and banks when clearing debts with one another.

Silver Certificates followed in 1878.

In 1913 the Federal Reserve Act divided the USA into twelve federal districts, creating the Federal Reserve bank, plus the Bureau of Internal Revenue (the IRS) for income tax collection.

After April 1933, gold certificates became the property of the Federal Reserve banks, though silver certificates remained in use. In June 1963 the Federal Reserve was authorized to issue one- and two-dollar bills. From March 1964 silver certificate redemption was made with silver "granules" until June 1968 when all US government redemption in silver ceased.

The $10 Eagle had devalued in 1837 to 15.05 grams of fine gold or $20.67 per troy ounce, a value of gold-to-silver of 16 to one. In 1849 the $1.00 gold coin was issued. Silver coins were seen as undervalued, and small denominations were disappearing. In 1853 the silver content was lowered by 6.9% (except for the dollar) with legal tender status fixed at $5.00 maximum.

The US's civil war saw silver soar to $2.94 per ounce, and Federal debt to $2 billion, with official National Banks required to invest in Treasury Bills. In 1866 the half-dime became the nickel with no silver content. In 1873 Congress omitted the silver dollar from its list of authorized coins. In 1900 Congress tied the US to a single "gold standard".

In 1933, President Franklin Roosevelt ordered that all holdings of gold certificates, gold coins and gold bullion in excess of 160 grams per individual had to be deposited with the US Federal Reserve at Fort Knox, accepting US dollar banknotes (like deposit slips) in their place. Only rare and unusual coin collections were exempt, along with special needs businesses e.g. dentists, artists, jewellers. Domestically until 1968 the US was on the silver standard.

In 1934 the US government devalued its currency in terms of gold to $US35 per troy ounce, a new value of gold-to-silver of 27 to one. By October 1941 and WW2 the Federal Reserve had become the world's largest central bank with 20,000 tonnes of gold and 80% of global reserves.

As US gold stocks diminished after 1950, Fort Knox dropping to 4,500 tons, to prevent it from "emptying" on August 15 1971 the US Government suspended the convertibility of the US dollar to gold, causing it to freely float on currency markets. In 1972 it became $US38, in 1973 its current book value $US42.2222. In 1974 the 160 grams limit on gold holdings by private individuals in the US was revoked.

In Mexico with their rich silver mines, the silver content and value of the Mexican Peso was at par with that of the US Dollar during the 19th Century. Click here for this history. In 1893, the drop in the price for silver bullion and the US adoption of the single gold standard meant the Mexican Peso fell against the US Dollar to 47 US cents at New York banks in 1900, and 40 cents in 1903. In order to attract ongoing foreign investment from investors in the US, Britain and France, particularly for its railways, in 1905 Mexico

mpra.ub.uni-muenchen.de

Mexico's cheap popular silver had been subsidising its imports up to then and while Mexican export prices halved, all import prices now doubled, bankruptcies, unemployment.

Turmoil followed in the form of the Mexican Revolution 1910-1920.

In 1929, foreign public debt was valued at 1.061 billion pesos (501 million US dollars), and interest payments were suspended until 1942.

After World War 2, the exchange value of the US Dollar to the Mexican Peso continued to rise.

Extracted mostly from fxtop.com 1953-2026

In 2026 the Mexican currency held an exchange value of around 18 pesos to the US dollar, or 5½ US cents

During the War of 1812, British Army Bills amounting to £3.44 million were issued from Quebec, backed by London and redeemed by 1820. Their wide acceptance as paper money led to the establishment of

Both UK and US coins circulated till 1858, then all UK coins were repatriated, the London Mint minting 1, 5, 10, 25 & 50 cent coins till the Canadian Mint opened in 1908, the Canadian $.

After the gold standard was abolished in 1933, the exchange rate was fixed at C$1.10 = US$1.00. It changed to parity in 1946, then back to a peg of C$1.10 = US$1.00 in 1949. The currency was allowed to float in 1950, whereupon it rose to a slight premium over the US dollar. Upon dropping in value in 1960, in 1962 it was pegged at C$1.00 = US$0.925. Since 1970 its value has floated.

In 2026 the Canadian dollar held an exchange value of 73 US cents.

1260 (35.3g) — 1270 (23.5g) — 1280 (21.4g) — 1300 (19.0g) — 1310 (16.2g) — 1320 (12.8g) — 1330 (14.4g) — 1340 (12.2g) — 1350 (11.5g) — 1360 (11.6g) — 1370 (11.1g) — 1380 (10.6g) — 1390 (9.3g) — 1400 (9.2g) — 1410 (8.8g) —1420 (8.7g) — 1430 (8.6g) — 1440 (7.7g) — 1460 (7.1g) — 1470 (6.9g) — 1480 (6.3g) — 1490 (5.9g) — 1500 (5.6g) — 1530 (5.2g) — 1540 (5.0g) — 1550 (4.5g) — 1710 (4.3g) — 1730 (4.2g) — 1740 (3.9g) — 1780 (3.8g)

Data: R. A. Goldthwaite, The building of Renaissance Florence (Baltimore/ London, 1980), pp. 429-30; M. Bernocchi, Le monete della Repubblica fiorentina (Firenze, 1974-78).

Extract from pierre-marteau.com/wiki/index.php?title=Italy:Money#Florence

** End of Report