Euroland from October 2014

Click here for prior Greek (and Euro) News from May 2010 to August 2013

Click here for "It’s all Greek to me" a glossary of eurozone crisis jargon

Click here for a timeline of the EU since 1951

Click here for a list of the 17 Eurozone countries in 2010 ranked by GDP

Click here for the year on which its 19 member countries joined the Eurozone (Latvia and Lithuania joined post 2010)

Click here for an article in June 2012 on Risk Weighted Assets within the Euro banking system

Click here for the background to the Libor London Interbank Offered Rate scandal in July 2012.

Go to Greek indebtedness status 2015

Go to Euro currency status in 2016

Go to latest update in August 2022 and April 2023

Greek (and Euro) News from October 18, 2014

The Maastricht Treaty of 1992, which built on almost four decades of convergence initiatives, limited budget deficits to 3 percent of gross domestic product and restricted government debt to 60 percent of GDP. The Lisbon Treaty of 2007 included the now-famous "no bailout" clause (Article 125) for signatories to the agreement. Both documents are now effectively meaningless. David Henry, Bloomberg

Heard on the Street

Greece Forces Reality Check as Bonds Crash

Weekend Australian

Richard Barley, The Wall Street Journal

Saturday, October 18th, 2014

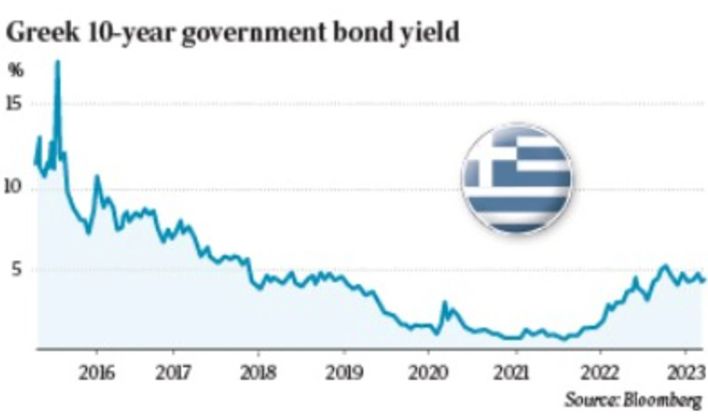

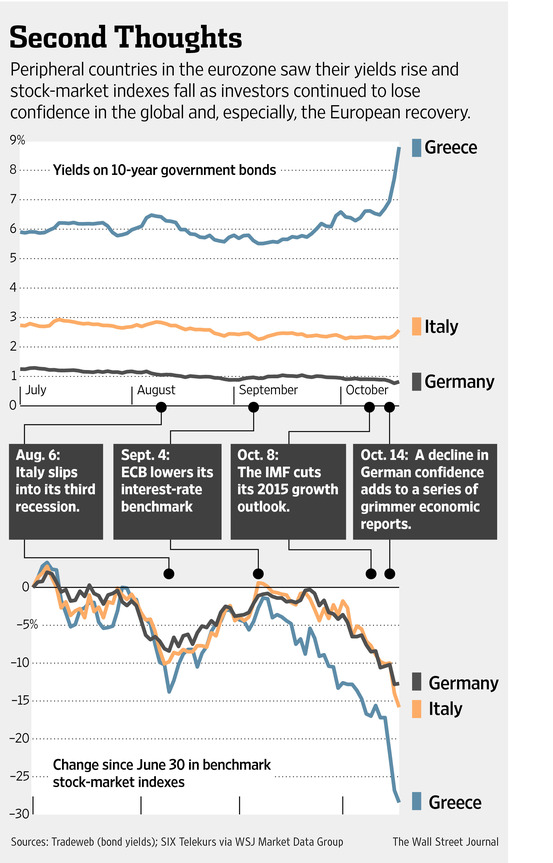

When Greece returned to bond markets in April, the question for investors was whether a yield of just under 5% was sufficient compensation for political risk. The answer is now clear: it wasn’t. But Greece isn’t the eurozone’s only problem on that front. Greek bonds are in free fall. Ten-year yields have risen to 8.8% from around 5.5% in the middle of September. Perhaps even more worryingly, three-year yields have risen to 7.4% from under 4%. The pain is spreading: Italian, Spanish and Portuguese bonds have been hit hard in the past couple of days.

Greece’s hopes of exiting its International Monetary Fund program and returning to market financing, as Ireland and Portugal have done, are in tatters as a result. This was in any case a lofty ambition: Greece would have needed to raise around EUR20 billion ($US25.5 billion) in the markets in 2015, Moody’s notes. With a credit rating as low as Greece’s, there is no dependable investor base to guarantee that this would be possible.

But if Greece cannot exit the IMF program, that poses a risk to the survival of the current government. With the left-wing Syriza party ahead in the polls and the possibility of elections early in 2015 rising, investors fear that Greece could be headed for fresh trouble.

Greece isn’t alone, however. Both domestically and at a European level, political risk has been increasing. Reforms have stalled. Fringe parties are on the rise and, even without necessarily gaining formal political representation, are influencing the debate. France has picked a fight with the European Commission over its budget deficit, raising tensions with Germany.

Until now, investors haven’t really reacted to this. That has been down to the search for yield sparked by ultra-loose global monetary policy, and the hope that the European Central Bank might yet buy government bonds in large amounts. Investors have loaded up on southern European government and corporate debt. As a result, many of them hold very similar positions.

Now the flow of central bank liquidity is drying up. The US Federal Reserve has pared its bond purchases, and the debate has turned to rate increases. The ECB’s efforts to date aren’t seen as a replacement. Investors have made extremely good returns on southern European government bonds this year; but the risk is that many now try to cash in those gains, particularly with year-end approaching. Who will buy their bonds is an unanswered question. Liquidity is poor as banking regulations have crimped traders’ ability to make markets.

This is a potentially toxic combination. In the past, falling prices have represented an opportunity to buy based on continued central bank support. Without that prop, the realities of extremely limp eurozone growth and inflation and rising political risk are coming home to roost. Once again, Greece may just be the catalyst.

Same Day

Extract: Echo of Crisis in Europe Gridlock

Marcus Walker and Charles Forelle, The Wall Street Journal

Tommy Stubbington, Josie Cox and Alkman Granitsas contributed to this article.

BERLIN: Echoes of the debt crisis reverberated across the eurozone Thursday amid mounting concern about the region’s stalled economic recovery and gridlock in the political system called upon to fix it. Stocks and government bonds fell hardest Thursday in the most fragile and fiscally precarious countries, Greece and Portugal. But the problems include the bloc’s biggest economies.

Even in powerhouse Germany, which escaped the 2010-12 debt crisis relatively unscathed, the government this week slashed its growth forecasts for this year and next, while a measure of economic confidence fell into negative territory for the first time in nearly two years. If the European market turmoil continues, it could test eurozone leaders’ belief that they have shored up their currency union with new rules on budgets, banks and bailouts.

European government officials have been “deluding” themselves that the crisis was over and the eurozone would recover, said Charles Wyplosz, professor of international economics at the Graduate Institute Geneva. Now global growth is weakening and exports aren’t enough to pull Europe out of trouble, but governments continue to debate austerity budgets while the European Central Bank has proved “impotent” at stimulating growth, he said. “What we see now is the revelation that the situation in the eurozone is very precarious,” he said. “We are sitting on a powder keg.”

Stock markets slid across the eurozone except in Germany, which eked out a small gain. US stocks recovered from early losses to end the day mixed. But the most dramatic development was a sudden spike in the yield on Greece’s 10-year government bonds, up more than a percentage point on the day to nearly 9%. Such a level makes the hopes of Greek politicians for returning to financing the country on bond markets next year all but impossible.

The eurozone selloff isn’t, so far, comparable with the financial panics that nearly broke the eurozone apart a few years ago. But it is reminiscent of the early days of the crisis in late 2009, when the unraveling of Greece’s budget led investors to begin to question the sustainability of the finances of other countries.

It was only after ECB President Mario Draghi promised in mid-2012 to do “whatever it takes” to save the eurozone that pressure on governments eased. But after two years of relative financial calm, European politicians have returned to bickering about economic policy.

Italy and France want to relax the German-led program of fiscal austerity that has been the centerpiece of the continent’s crisis response. Rome and Paris have both unveiled budgets for 2015 that put off deficit-cutting in favor of greater stimulus, arguing that the eurozone is suffering from a lack of demand.

“Relaunching growth is the best way to stabilize the market,” French President Francois Hollande told reporters on Thursday. He said European Union leaders need to address “the weak state of the European economy” at their planned summit next week.

“Either we all emerge united, or the crisis that is returning dramatically to the international markets will have no winners,” Italian Prime Minister Matteo Renzi told a meeting of European and Asian leaders in Milan.

But their push for more leniency sets up a potential collision with Germany and other northern EU countries, which worry that loosening budget discipline to juice growth would reduce the pressure on Rome and Paris to shake up their labor markets and otherwise overhaul their economies.

German Chancellor Angela Merkel gave no ground Thursday. “All member states must fully respect the strengthened rules” on government debt and deficits, she told lawmakers in Berlin.

Critics have long warned that a sustainable common currency requires something more — a political and fiscal union that puts Europe’s collective financial muscle at the service of its weaker members. “For the past year, investors have lost sight of the eurozone, but now they’re having a look because of what’s happening between France and Germany, and the noise from Greece. And they don’t like what they see,” said Nicolas Véron, fellow at Brussels think tank Bruegel and the Washington-based Peterson Institute for International Economics.

Government-bond yields rose in every major eurozone country. Yields rise when prices fall. After Greece, the worst hit were fellow bailout recipients Portugal and Ireland as well as Italy, where the economy hasn’t grown since early 2011. French bonds — which have long benefited from a flight to relative safety — weakened as well. Ratings firms have recently downgraded their outlook on France’s government debt, casting doubt on Mr Hollande’s plans to repair public finances amid a prolonged period of economic stagnation. Spain attracted unusually weak demand for long-term bonds it sold on Thursday.

|

Greek debt plan suffers blow as ECB cuts banks’ access to cash

The Australian

Jacquelin Magnay

Friday, February 6th, 2015

THE new Greek government’s plans to refinance its crippling debt hit a major stumbling block yesterday as its key creditor, the European Central Bank, tightened its lending criteria to Greek banks, sending fresh shock waves through European markets. Greek Prime Minister Alexis Tsipras and Finance Minister Yanis Varoufakis also met muted response to their bold plans for lenders to wipe half of their €240 billion ($352bn) debt; with France’s Socialist President Francois Hollande warning that Greece had to respect the rules.

“There is also respect for European rules, which are imposed on everyone — France, too — and it’s not always simple,” Mr Hollande said as Mr Tsipras stood beside him at the Elysee Palace. Mr Varoufakis was expected to meet the German Finance Minister Wolfgang Schauble overnight in Berlin in what were poised to be tense discussions. German Chancellor Angela Merkel yesterday warned Greece that the eurozone was not divided, despite his whistlestop tour of Europe to garner support. “There were no substantial differences among other eurozone states over the need for Athens to stick to its commitments over its debt,” she said.

The ECB has ratcheted the pressure on Greece and it will no longer allow Greek banks to use the government debt as collateral for loans from as early as yesterday, making it difficult for them to raise capital. The Financial Times reported that the ECB refused to raise the agreed cap on the short-term treasury bills from €15bn to €25bn.

Mr Varoufakis told the German weekly Die Zeit the ECB “should support our banks so that we can stay afloat”. He told another German paper, Die Welt, that Greece was an unemployed worker trying to pay the mortgage. “Would you give him another loan so he can make payments on his house? That cannot work. I’m the finance minister of a bankrupt country!” he said. But he sought to calm the markets insisting the country’s banking system “remains adequately capitalised and fully protected”.

The ECB said it was ending a special lending waiver for Greece because “it is currently not possible to assume a successful conclusion of the program review”. The ECB waiver had allowed banks to pledge their Greek bonds as collateral, even though the securities did not meet standards for a minimum credit rating. Greece faces key payments on its debt at the end of February and again at the end of May.

The Greek banks have enough capital for several months but will run into a liquidity crisis, unless they’re able to raise fresh capital around the middle of the year. This will only come at much less attractive interest rates.

With money flowing out of the Greek banking system and unemployment at record levels above 25 per cent, the Syriza party elected a fortnight ago, faces a delicate and urgent task of reassuring Europe it will not default on its loans, but also satisfy its voters that it has reconfigured the loan terms to allow an easing of strict austerity measures.

Mr Tsipras said he was still optimistic of a viable and mutually acceptable solution with the EU after holding meetings in Brussels with European Commission chief Jean-Claude Juncker and EU President Donald Tusk. The discussions centred on a four-year reform plan for Greece to tackle corruption and tax evasion. “I am convinced we can work together to get out of the crisis in Greece and to help Europe overcome the crisis,” Mr Tsipras said.

IMF casts doubt on Greece’s revised bailout plan

The Australian

AFP

Thursday, February 26th, 2015

BRUSSELS: Creditors yesterday sounded a warning about Greece’s revised bailout plan despite eurozone finance ministers backing the reforms proposed by Athens in exchange for a four-month financial lifeline. The news Greece will remain afloat and in the single currency for the time being buoyed European stock markets, with London’s index hitting a record high. The International Monetary Fund, however, and the European Central Bank, expressed reservations about the plan, even though it represents an apparent climbdown for Greece’s new left-wing Prime Minister Alexis Tsipras.

The 19 eurozone ministers signed off in a telephone conference on the plan, which Athens submitted with 45 minutes to spare on Tuesday to meet a deadline set by Greece’s creditors at 11th-hour talks last week. Several parliaments, including Germany’s, must approve the extension before the bailout expires on Saturday, while details must be hammered out in coming weeks.

“We avoided a crisis but there are many challenges ahead,” EU Economic Affairs Commissioner Pierre Moscovici said. Greece’s finance ministry said it had “won a few weeks” of breathing space to put forward alternatives to its loathed current bailout program. Athens stocks closed up 9.81 per cent amid growing confidence about the agreement. In London the FTSE 100 index reached its highest level on record, beating its previous peak in December 1999, ending the day up 0.54 per cent to 6.949.63 points. IMF chief Christine Lagarde cautioned that the Greek list of proposals “is not conveying clear assurances that the government intends to undertake the reforms envisaged”.

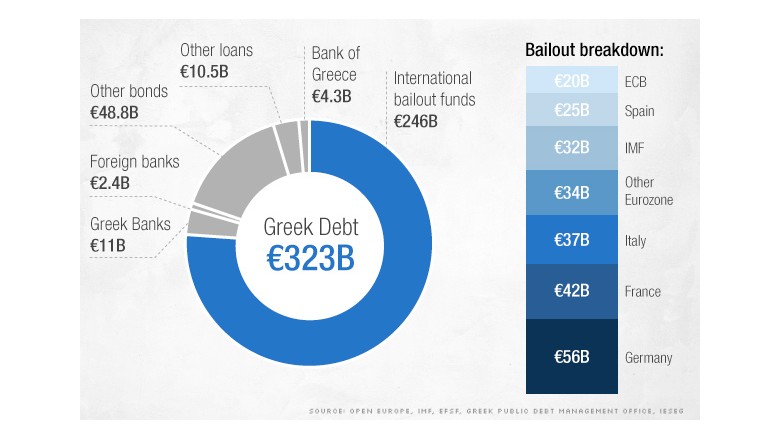

Greece has had to be bailed out twice — in 2010 and 2012 — to the tune of €240 billion ($348bn), leaving the country with debt worth 175 per cent of annual economic output. Mr Tsipras, whose Syriza party won elections in January, has demanded an end to the bailout program and the reduction of the harsh austerity measures imposed by Greece’s main creditors — the European Union, ECB and IMF.

The eurozone ministers said after their hour-long phone call early yesterday that those three institutions believed Greece’s new plan was “sufficiently comprehensive to be a valid starting point” for further negotiations. “We therefore agreed to proceed with the national procedures with a view to reaching the final decision on the extension by up to four months,” they said. If the deal is backed by eurozone parliaments, the parties will then have to hammer out a full agreement by the end of April, so Athens can meet debt payments falling due through June.

German Chancellor Angela Merkel — the austerity champion at the head of Europe’s biggest economy — asked her conservative party at a meeting yesterday to back the extension when the lower house votes tomorrow night. But she stressed that the “task is by no means done”, an MP said. French President Francois Hollande hailed it as a “good compromise”. Spanish Finance Minister Luis de Guindos — who faces a challenge from left-wing parties in an election expected later this year — said it was a “positive solution”.

The reform list unveiled by Athens includes steps to tighten up on tax collection and government spending, especially on the civil service and pensions, and crack down on corruption. But it also contains measures to offset the pain caused by the austerity policies attached to the bailout program. The measures included free electricity for 300,000 poor families, free access to health care, food and public transport coupons and aid for those on low pensions.

No sooner had the eurozone ministers announced the deal than reservations began to emerge. ECB head Mario Draghi said some of the reforms “differ” from existing programs, and that any new steps must be of “equal or better quality” in cutting debt. Diplomats in Brussels said many had reservations about the accord but all recognised it was better to have an initial agreement to avoid the dangers a failure would have caused.

But Europe has in many ways just put off the challenge of dealing with Greece’s long-term debt, analysts said. “This deal is just a stopgap, and nothing has yet been done to tackle Greece’s unsustainable debt position,” Jennifer McKeown of Capital Economics said. “A disorderly default and euro exit remains a distinct possibility in future.”

Greece’s governing left divided over debt terms

The Australian

Stelios Bouras, The Wall Street Journal

Wednesday, May 27th, 2015

Extract: Greece’s lenders are particularly worried about vocal threats by Syriza’s Left Platform, a hard-line leftist faction within the party, to reject any deal that crosses ideological “red lines” by cutting pensions or workers’ rights, that is, making corporate layoffs easier to manage for struggling firms. Prime Minister Alexis Tsipras’s difficulty in selling a painful compromise to Syriza’s hard left, as well as to other parts of his ideologically diverse party, has become the largest obstacle to a deal.

Greece must agree on a list of policies with lenders in time to avoid defaulting on a series of loan repayments to the IMF in mid-June. Although the government probably has enough cash to repay a €300 million ($418m) loan due June 5, it almost certainly can’t meet three further payments totalling about €1.25 billion on June 12, 16 and 19, European officials say. Greece needs a deal as soon as possible so it can service its IMF debts, government spokesman Gabriel Sakellaridis said yesterday. “To the extent that we are in a position to pay our obligations, we will pay our obligations,” he said, adding: “It’s the government’s responsibility to be in a position to pay its obligations.”

The European Central Bank has told eurozone governments it would allow Greek banks to buy more short-term Greek government debt if an economic-overhaul agreement between Athens and creditors is imminent. That would allow Greece to survive until July, when further debts fall due and fresh bailout loans will be needed. Lenders, led by the IMF and Germany, insist Greece enact further budget austerity, cut the cost of its pension system, step up privatisation and make corporate lay-offs easier, among other measures. The creditors’ hard line has exasperated Syriza leaders, who won election in January on a promise to end such painful retrenchment.

When Syriza’s central committee debated the state of debt negotiations this weekend, the Left Platform submitted a motion calling for the government to default on the IMF loans rather than compromise its principles. The proposal was narrowly rejected, with 95 people voting against and 75 in favour. The Left Platform’s leader, Energy Minister Panagiotis Lafazanis, told the meeting default was preferable to surrender, even if it meant Greece tumbling out of the euro. “Who says that an exit from the euro and a return to the national currency is a catastrophe?” Mr Lafazanis said.

The central committee agreed on a text saying any deal with creditors must involve no pension cuts, a small budget surplus before interest, increased public investment and a restructuring of Greece’s debt — terms that lenders are unlikely to accept.

Bloomberg article a few days ago

What a Return to the Drachma Really Looks Like

By Peter Coy, Nick Malkoutzis, Carol Matlack, and Gabi Thesing

May 24, 2012

Extract: From a distance, returning to the drachma seems like a great solution for Greece. Economists such as New York University’s Nouriel Roubini say that by quitting the euro, Greece would seize control of its fate. It could pay off its euro debts with less valuable drachmas — stiffing creditors.

Yet, if Greece does leave or is kicked out of the single currency, it will most probably suffer inflation, worker layoffs, capital flight, shortages of essential commodities, not to mention civil unrest.

(Outward) Beauty is one thing Greece doesn’t need to import, and it will be more attractive on sale as a result of a currency devaluation. Tourism would be the largest beneficiary of a devaluation because it would make Greece a cheaper travel destination than Turkey, Croatia, and other vacation spots. “A German guest complained the other day that ‘You don’t have an economy, government, or money, but you’re charging me €4 for a coffee,’?” says Costis Mouzakis, who works in a downtown Athens hotel. Still, tourists might not come for bargain holidays if Greece is in chaos and xenophobia is running high. Air Berlin, a discount carrier, says its Greek business has declined about 30 percent from a year ago.

In terms of exports, aside from tourism and shipping, there are also petroleum and aluminum products, medicines, fish, iron, piping, vegetables, fruits, cotton, cheese, fur and, of course, olive oil. Income from those exports, however, is not enough to pay for everything Greece imports, from crude oil and vehicles to computers and consumer electronics.

Whether in or out of the euro region, Greece has to lower its costs, mostly via wage cuts, and increase efficiency by streamlining government (and the entrenched interest groups). Mind you, that’s a worldwide problem — Steve

Greece looms large over G7

The Australian

AFP

Monday, June 8th, 2015

ELMAU CASTLE: Tensions between Greece and its creditors are set to dominate the G7 summit in Germany, amid fears the debt-wracked country could crash out of the euro and rock the world economy. German Chancellor Angela Merkel, a champion of tough eurozone reform and austerity, began hosting the other leaders of the Group of Seven industrialised democracies — US, Britain, France, Italy, Canada and Japan — overnight.

Also at the two-day power meeting will be Greece’s international creditors — the EU, European Central Bank and International Monetary Fund — which have wrangled for weeks to hammer out a reform plan that would unlock a final €7.2 billion ($10.4bn) in bailout funds Athens desperately needs. European Commission president Jean-Claude Juncker and EU president Donald Tusk were among the guests due to speak overnight, with IMF chief Christine Lagarde joining them today.

In a sign of growing tensions ahead of a key deadline at the end of the month, Greek Prime Minister Alexis Tsipras has dismissed creditors’ demands as “absurd”. Mr Juncker snubbed a phone call from the radical leftist leader over the weekend, with an EU official reportedly saying there was “nothing to discuss”, although Mr Tsipras, Ms Merkel and French President Francois Hollande later spoke by phone. The three leaders “took stock of the situation to help move forward the negotiations between Greece and the three (creditor) institutions”, a French source said yesterday.

Athens last week withheld a €300 million loan repayment to the IMF, opting to group four scheduled tranches into a single payment at the end of the month. Mr Tsipras argued that a “cynical” policy of economic asphyxiation and harsh austerity being applied to Greece would ultimately impact other European states in economic difficulty.

US President Barack Obama touched down in southern Germany last night. The guests were treated to a Bavarian-style welcome with children in traditional dress handing them flowers. Mr Obama was expected to join Ms Merkel for local beer, pretzels and oompah music at a nearby village. His administration has urged Europe to resolve the Greece issue. Washington has also voiced strong concern about what is set to be the other big G7 topic, the latest flare-up in fighting in Ukraine, which last week claimed scores of lives and threatened to derail a ceasefire.

Russia’s role in the conflict will for a third time keep President Vladimir Putin away from a G7 summit. Japanese Prime Minister Shinzo Abe and Canada’s Stephen Harper stopped in Kiev on their way to Germany to voice support for the government of President Petro Poroshenko. Mr Putin insisted that Russia was not a threat to the West. “There’s no need to be afraid of Russia,” he told Italian newspaper Corriere della Sera, adding “only a sick person — and even then only in his sleep — can imagine that Russia would suddenly attack NATO”.

Ms Merkel had hoped to use the picture-book setting of lush Bavarian meadows and magnificent mountain peaks to showcase the homely side of Europe’s biggest economy while searching for consensus on a catalogue of pressing global issues. Instead, the event threatens to be overshadowed by two leaders who are absent, said the Munich daily Sueddeutsche Zeitung. “While the government stoically insists everything is normal, two virtual guests are charging up the atmosphere in a way that threatens to dominate the summit: Russian President Vladimir Putin and, some distance behind him, Greek Prime Minister Alexis Tsipras,” it said. “The renewed fighting in eastern Ukraine and the Greek debt drama will shape at least the public perception of the discussions, summit organisers believe.”

On the official agenda as leaders huddle in the luxury Elmau Castle resort are issues from climate change and Ebola to women’s rights and the fight against Islamist militancy.

|

Weekend Australian

The Times, AFP

Saturday, June 13th, 2015

Diplomatic efforts to prevent an imminent Greek default and exit from the euro ended in failure yesterday as the International Monetary Fund pulled out of the negotiations. Twenty-four hours of talks in Brussels between German Chancellor Angela Merkel, French President Francois Hollande, the European Commission, the IMF and Greek Prime Minister Alexis Tsipras ended without agreement.

“There are still major differences between us in most key areas,” IMF spokesman Gerry Rice said. “There has been no progress in narrowing these differences recently. Thus we are well away from an agreement.”

Eurozone negotiations are expected to extend over the weekend as EU officials warn that without agreement early next week, Greece faces a banking collapse, state bankruptcy and default on its debts. A failure to secure a detailed draft agreement before Wednesday, a day before a meeting of eurozone finance ministers, is expected to trigger a move by the European Central Bank to cut aid to Greek banks.

Credit ratings agency Moody’s warned signs of an impending Greek banking crisis were mounting as capital flight, combined with possible ECB restrictions, heralded a new stage in the country’s financial crisis. “The continuation of these outflows significantly increases the risk that the local authorities will impose capital controls, with a negative effect on Greece’s market integration with the rest of the euro-area markets,” the agency said.

After the collapse of the talks, European Council president Donald Tusk warned Mr Tsipras that the time for talking had run out. “There’s no more time for gambling. The day is coming I’m afraid that someone says that the game is over,” he said. German Bundesbank president Jens Weidmann said that “risk of insolvency is increasing by the day” and warned the eurozone and Greece about the impact of bankruptcy and default.

Hundreds of demonstrators took over Greece’s finance ministry yesterday to protest against new austerity measures that look certain to be imposed on the country’s government by the eurozone and IMF in any deal. Militant members of the pro-communist PAME trade union stormed the government building in central Athens at dawn, tearing down the EU flag and unfurling a giant banner. “We have bled enough, we have paid enough,” the banner read, alongside pictures of Mr Tsipras and previous Greek prime ministers who have agreed to eurozone and IMF cuts.

Mr Tsipras has signalled that he might sign up to fiscal targets that would cut pensions for the poorest and increase VAT rates in order to unlock €7.2 billion ($10.45bn) in loans that Greece needs to pay back debts this month.

Ms Merkel faces growing dissent within her conservative party over efforts to keep Greece in the eurozone after months of drawn-out, quarrelsome debt talks. Even her long-serving and loyal Finance Minister, Wolfgang Schauble, appears to be losing patience with Greece, and analysts have noted a recent divergence in their approaches to resolving the crisis. If and when a deal is finally clinched, the Chancellor will, despite her popularity, have to invest much political capital to keep her conservatives on side, especially if an agreement requires the German parliament’s approval, analysts say.

Mr Schauble, Ms Merkel’s pro-European right-hand man in the years-long battle to fix the eurozone, has remained unwavering on the need for Athens to stick to its commitments. Observers say his uncompromising stance now contrasts with that of Ms Merkel, the long-time austerity champion who has increasingly engaged directly with the hard-Left Mr Tspiras in the quest for a political solution.

Faced with reporters’ questions on whether a rift had developed between Mr Schauble, the unbending trained lawyer, and Ms Merkel, a pragmatic former scientist, his ministry stressed that the two were “definitely acting in concert” on Greece. “At the chancellery there’s the idea you have to negotiate with Greece,” said political analyst Pawel Tokarski, of the German Institute for International and Security Affairs. “At the finance ministry there’s increasingly less confidence of reaching an agreement.”

After four months of thorny cash-for-reforms negotiations between Athens and its creditors — aimed at releasing the badly needed €7.2bn final tranche of Greece’s €240bn bailout — Ms Merkel must also contend with a rising chorus of backbench disenchantment. “In Europe’s decisions on the rescue of Greece, big sinful regulatory breaches were committed,” said Christian von Stetten, an MP from Ms Merkel’s Christian Democratic Union party, according to the Handelsblatt business daily. “That can’t go on like that.”

Given the overwhelming Bundestag majority of Ms Merkel’s left-right coalition, she would probably not suffer an outright defeat — past bailouts have always sailed through. But Ms Merkel could face greater rebellion in the ranks than in previous ballots, as well as critical opposition from her traditionally more pro-Greece junior partners, the Social Democrats.

Greek debt: Merkel urges deal before Monday summit

BBC Online

Saturday, June 20th, 2015

German Chancellor Angela Merkel has warned there must be a deal between Greece and its creditors ahead of Monday's emergency EU summit. Otherwise, she said, the summit would not be able to make any decision.

Greece has less than two weeks remaining to strike a deal or face defaulting on a €1.6bn IMF loan repayment. There are fears about the health of Greek banks, amid reports more than €4bn has been withdrawn this week. On Friday, the European Central Bank (ECB) approved more emergency help for the banks. The amount of extra funding has not been officially disclosed.

Meanwhile, Russia says that it will consider granting a loan to Greece if it is asked.

If Greece fails to make the repayment due to the International Monetary Fund, it risks having to leave the eurozone and possibly also the EU. The European Commission, the IMF and the ECB are unwilling to unlock bailout funds until Greece agrees to reforms. They want Greece to implement a series of economic changes in areas such as pensions, VAT and on the budget surplus before releasing €7.2bn of funds, which have been delayed since February.

The emergency summit of leaders from eurozone nations will be held in Brussels on Monday, after negotiations on Thursday failed. "Let me make it very clear as to the expectations," Mrs Merkel said on Friday. "Such a summit can only become a summit of decisions if there is something to base a decision on. It is up to the three institutions [the ECB, IMF and European Commission] to assess this, and up to now we don't have that assessment."

Valdis Dombrovksis, European Commissioner for the euro, told BBC Radio 4's Today programme that there had been "a strong signal" from the Eurogroup to Greece "that it's [the] last moment to engage seriously in negotiations". Responding to the reports of big cash withdrawals by Greek savers, he said: "It's very clear that one of the most urgent things Greece needs is financial stability."

The Reuters news agency said withdrawals by Greek savers between Monday and Friday reached about €4.2bn, which represents about 3% of household and corporate deposits held by Greek banks at the end of April. Close to €1bn was withdrawn on Friday alone, the financial website Euro2day said. "There are no lines [queues] or panic, it has been a quiet and gradual phase of withdrawals," one banker told Reuters.

A fully fledged run on the banks could upset the plans of the Greek government and its creditors, says BBC Europe correspondent Chris Morris. He says that any introduction of capital controls will depend on the behaviour of the Greek people. He says that if the outflow of deposits from banks reaches alarming levels which no-one can really cope with, then the decision is taken out of policymakers' hands.

Greek Prime Minister Alexis Tsipras said on Friday that there would be a solution to Greece's debt crisis. "The [eurozone] leaders summit on Monday is a positive development on the road toward a deal," Mr Tsipras said in a statement. "All those who are betting on crisis and terror scenarios will be proven wrong." He added: "There will be a solution based on respecting EU rules and democracy which would allow Greece to return to growth in the euro."

Mr Tsipras was at an economic forum in St Petersburg in Russia on Friday with a delegation of ministers and business leaders. At the forum, Greece and Russia signed a memorandum on extending the planned Turkish Stream gas pipeline to Europe through Greek territory. Athens said funding would come from Russian state development bank VEB. Greek Energy Minister Panagiotis Lafazanis said at the signing ceremony that Greece needed support and not pressure, and that co-operation with Russia was not aimed against other countries or Europe. President Vladimir Putin's spokesman, Dmitry Peskov, said Russia would consider granting Greece a loan. But the issue was not raised in talks between Mr Putin and Mr Tsipras, he said.

|

MarketWatch

Viktoria Dendrinou and Nektaria Stamouli

Monday, June 22nd, 2015 6:32 p.m. ET

(published 11:32 a.m. Tuesday AEST)

BRUSSELS — Greece’s creditors suggested for the first time that a deal to avert the country’s bankruptcy was in sight after an 11th-hour proposal submitted by Athens on Monday made a significant concession on pension cuts. The currency union’s finance ministers, who met Monday afternoon ahead of a meeting of eurozone leaders, said that more work was needed to ensure Greece’s figures were in line with creditors’ demands but that talks would continue with the hope of reaching an agreement later this week.

The new offer was a potentially decisive breakthrough in the bailout negotiations after four months of fractious talks. “Some promising things have happened, including today’s talks,” said European Council President Donald Tusk. “The latest Greek proposals are the first real proposals in many weeks.”

A first assessment from the institutions overseeing Greece’s bailout—the European Commission, the European Central Bank and the International Monetary Fund—found the new plans to be “broad and comprehensive,” said Jeroen Dijsselbloem, the Dutch finance minister who presided over the talks. “But they really need to look at the specifics to see whether it adds up in fiscal terms, whether the reforms are comprehensive enough for the economic recovery to take off again,” he said.

Gabriele Steinhauser, Nektaria Stamouli and Natalia Drozdiak contributed to this article.

C W 2 hours ago

Greece- Instead of not paying back any of the money we promised to pay back we've decided to pay back 5%. Now give us more billions…

Only a willfully ignorant fool doesn't see where this is going…

Volker Hildebrandt 2 hours ago

Lowering pensions will let more air out of the already poor economy , which means less taxes and the same as previous disability to pay back the debt.

S.K. JONES 2 hours ago

Tsipras looks happy………………

Volker Hildebrandt 2 hours ago

@S.K. JONES ..and he fooled them again.

S.K. JONES 2 hours ago

I think it is hilarious; Tsipras embarrassed them. He called them criminals and publicly insulted them. And he won. And that's how you negotiate…………….

No one wants a Greek default. Tsipras won; who that is behind him in the hall doesn't look quite as happy.

Because he is getting more money……………

Wayne Parker 1 hour ago

Do the idiots loaning Greece more money get to write off their loss on their taxes???

Greece will never, ever be able to re-pay their debt. They need to just go away.

Greece debt crisis: Eurozone refuse bailout extension

AP and Network Writers

Sunday, June 28th, 2015

At midnight Saturday, June 27th, Greece's parliament voted in favor of Prime Minister Alexis Tsipras' motion to hold a referendum on the international creditors' proposed deal for reforms in exchange for loans. The Greek government said it would recommend Greeks vote “no” in the referendum.

Prime Minister Alexis Tsipras, late on Friday, had called for a referendum in a week, July 5, after the rescue lenders brought their proposed bailout deal on Thursday. The Greek government rejected the deal as imposing cuts that are too harsh on the general population.

The call on the people to vote against the proposed deal angered many of its eurozone partners. “We must conclude that, however regretful, that the program will expire on Tuesday night, June 30. That is the latest date that we could have reached an agreement,” said Jeroen Dijsselbloem, the top eurozone official, effectively ending five months of fruitless negotiations. “The Greek authorities have asked for a month extension. But in that month there can be no disbursements,” he said. “How does the Greek government think that it will survive and deal with its problems in that period? I do not know,” Mr Dijsselbloem said.

Greek Finance Minister Yanis Varoufakis insisted that Athens and lenders still had time to improve the deal — and avoid a referendum. “There is no reason why we can’t have a deal by Tuesday. If the deal is acceptable we will recommend a positive vote,” he said. But the other ministers had no time for that.

Mr Varoufakis was far from certain the voters would agree with the government. He spoke of “the high possibility that the Greek people will vote against their advice. It’s a sad day for Europe but we will overcome it,” Varoufakis said. Greece has a debt due on Tuesday and its bailout program expires the same day, after which it is unclear whether its banks would be able to avoid collapse, an event that could be the precursor to Greece leaving the euro.

Across Athens, people started flocking to cash machines shortly after Mr Tsipras announced the referendum around 1am Saturday, Australian time. The queues grew over Saturday, though the number of people and the availability of cash varied widely. The Bank of Greece assured in a statement Saturday that the flow of cash will not be interrupted.

The concern over what awaits the country in the hours and days to come was palpable. At one branch of Pireaus Bank in central Athens, one of very few that opens on Saturdays, about 50 people queued up in the early morning before they found out the bank would not open at all. An elderly woman fainted.

Extract: Greek debt crisis: Banks to remain shut all week

BBC

Monday, June 29th, 2015

The Greek government has confirmed that banks will be closed all week, after a decision by the European Central Bank not to extend emergency funding. In a decree, the government cited the "extremely urgent" need to protect the financial system due to the lack of liquidity. Cash withdrawals will be limited to €60 ($88 AUS) a day for this period, the decree says.

Greece risks default and moving closer to a possible exit from the 19-member eurozone. Shares across Asia fell in trading on Monday on fears of a Greek exit, with the euro dropping 2% against the US dollar. Government borrowing costs in Italy and Spain have also risen.

The decree was published in the official government gazette after the Greek cabinet took the decision late on Sunday. The document said the measures — including the shutting down of the Athens stock exchange on Monday — were agreed as a result of the eurozone's decision "to refuse the extension of the loan agreement with Greece". The €60 restriction on withdrawals will not apply to holders of foreign bank cards. Mr Tsipras also said that Greek deposits were safe.

Greeks have been queuing to withdraw money from cash machines over the weekend, leaving a number of ATMs dry. However, the decree said that the cash machines would "operate normally again by Monday noon at the latest".

|

The Australian

AFP, AP

Tuesday, June 30, 2015 2:51PM AEST

“The Greek government will make use of all our legal rights,” Greek Finance Minister Yanis Varoufakis told the London Daily Telegraph. “We are taking advice and will certainly consider an injunction at the European Court of Justice. The EU treaties make no provision for (a) euro exit and we refuse to accept it. Our membership is not negotiable.”

No country has ever withdrawn from the common currency, but the prospect of Greece crashing out of the euro has grown after its long-running debt crisis took a dramatic turn over the weekend. Talks between Greece and its international creditors collapsed after Athens rejected demands for austerity measures in return for cash and announced it would hold a referendum on the deal on Sunday. European leaders have urged Greek voters to back the hotly disputed terms, warning that rejecting the proposals would be a vote against staying in the eurozone.

According to a poll conducted by Kapa research for the Greek weekly Vima before the referendum was called, 47.2 per cent of Greeks were for the bailout and 33 per cent against with 19.8 per cent not expressing an opinion. A second poll, conducted by the Alco firm found an even higher majority in favour of a deal with Europe: 57 against 29 per cent.

Throughout Greece, massive queues formed at gas stations, with worried motorists seeking to fill up their tanks and pay with credit cards while they were still being accepted. Although credit and cash card transactions have not been restricted, many retailers were not accepting card transactions. Electronic transfers and bill payments are allowed, but only within Greece. The government also stressed the controls would not affect foreign tourists, who would have no limits on cash withdrawals with foreign bank cards.

For emergency needs, such as importing medicine or sending remittances abroad, the Greek Treasury was creating a Banking Transactions Approval Committee to examine requests on a case-by-case basis.

Extract: Greece defaults on €1.6bn debt payment

The Australian

Wednesday, July 1st, 2015 8:59AM AEST

The IMF has put out a statement on Greece’s €1.6bn debt default.

“I confirm that the … repayment due by Greece to the IMF today has not been received,” said fund spokesman Gerry Rice. “We have informed our executive board that Greece is now in arrears and can only receive IMF financing once the arrears are cleared.” Rice confirmed that Greece had made a last minute request to have the payment extended, but said the board did not rule on it. The extension request “will go to the IMF’s Executive Board in due course, he said.

More than 10,000 pro-Europe Greeks crammed into Athens’ central Syntagma Square overnight, urging the left-wing Syriza government to agree a last minute deal with Europe and to vote yes in Sunday’s referendum to continue the country’s austerity measures. But as the hours ticked towards a calamitous default to the International Monetary Fund and a cancellation of the EU bailout that will come within hours a huge thunderstorm, complete with dramatic lightning and heavy rain lit up the city in a portent of the rage that has been growing for days.

The local fury is directed at both the European Union and the Syriza government for inflaming the mess. Only hours earlier the Greek government had reopened negotiations with the European Union, offering a different proposal for a new, third economic bailout, this time for nearly €30bn, as the country steeled itself to default to the International Monetary Fund at 1am local time (8am AEST).

In the coming weeks without a bail extension or new deal Greece will most probably default on a further €3.5bn repayment to the European Central Bank. It is also due to pay £2bn in pensions and wages to its civil workforce.

The Greens put forward the new bailout plan as the European Union’s Financial Stability Facility (EFSF) announced the last loan tranche of €1.8bn would not be available to Greece once the deadline passes at midnight Brussels time. The institution said another part of the deal, a €10.9bn in notes to cover bank recapitalisation would also be cancelled. The EFSF said the bailout to Greece, which started in February 2012 was provided with the most favourable lending conditions ever offered, saving Greece €16bn in the past two years. It said the outstanding loan to the EU is now €130.9bn.

But under the last gasp new proposal the Greeks want all of the old debts to be "restructured and reprofiled", something that the EU has rejected in the past. Finnish minister Alex Stubb said following a telephone conference of the eurozone finance ministers, that an extension of the program or a haircut (of debt) was not possible. German chancellor Angela Merkel ruled out new negotiations with Greece until after the Greek referendum on Sunday. Germany has already underwritten Greece with €56bn of taxpayer moneys and would be the main creditor in any new deal.

Greece also asked — for the second time in June — for its current bailout to be extended for “a short period of time” to avoid the technical default to the IMF by a developed country and sidestep any reputational calamity. Exasperated European observers considered this latest Greek offer to be a political stunt that might be received more favourably within the country, than outside of it, as Greece did not offer any concessions as part of the new loan request.

European leaders have made it clear the July 5 referendum that Tsipras called late Friday is a decision about whether Greece will remain a member of the EU: a no vote would result in a Greek exit and reversion to the drachma; a yes vote would mean the end of Tsipras’political leadership.

At the rally opportunistic flag-sellers did a brisk trade in the European flag (cost €5) before the damp conditions disbursed much of the crush.

A fuming mayor of Athens George Kaminis claimed the government had misled the Greek people. He roused the crowd — appearing much wealthier and more professional than the previous night’s No rally — by insisting the referendum on Sunday was a simple "Yes or no to Europe? That is the dilemma” and supporters chanted “yes to Europe".

Greeks have been mobilised by the suddenly imposed financial restrictions that have sharpened focus on the broader Greek economic catastrophe as well as curtailing their daily withdrawals from ATM’s to €60. Banks were closed Tuesday and are only expected to open for a few hours on Thursday to assist in pension distributions.

Extract: Greeks Set to Reject Creditors’ Bailout Terms, Projections Show

Nektaria Stamouli and Stelios Bouras

The Wall Street Journal

Monday, July 6th, 2015 6:51AM AEST

ATHENS: Greek voters were set to resoundingly reject the terms of an international bailout on Sunday.

With more than 87% of votes counted, preliminary results showed more than 61% of voters had cast ballots against creditors’ demands in the historic referendum — a heavier-than-expected victory for the “no” campaign against the austerity policies demanded by Greece’s lenders: the rest of the eurozone and the International Monetary Fund.

Voter turnout, based on the partial counting of votes, was reported at about 62%. Opinion polls conducted during Sunday by private broadcasters had pointed to a narrower majority for the “no” camp.

British Prime Minister David Cameron plans to lead a meeting Monday with the governor of the Bank of England and other top officials to assess the fallout from the vote, U.K. Treasury chief George Osborne said on Sunday.

Investors in European stocks and bonds are gearing up for some big market moves, with volatility expected to last for a while as political wrangling continues no matter the final outcome.

“They tell us we will be kicked out of the euro. I don’t believe them: I voted ‘no,’ ” said Greek retiree Aristotelis Georgantas. Under Greece’s austerity program since 2010, the country’s creditors and past Greek governments have cut his pension to a third, he said, and he is supporting his unemployed son and his three children.

Same Day 10:47am

The Australian

Jacquelin Magnay, European Correspondent

In a televised address after the referendum, Mr Tsipras insisted the vote did not mean a break with Europe. He emphasised that euro membership is meant to be “irreversible”, with no legal avenue to boot a country out. “Together we have written a bright page in modern European history,” he said. “This is not an mandate of rupture with Europe, but a mandate that bolsters our negotiating strength to achieve a viable deal.” Tsipras claimed the creditors — the ECB, the European Commission and the International Monetary Fund (IMF) — would finally have to talk about restructuring the massive, 240 billion euros ($A352.66 billion) debt, Greece owes them.

“This time, the debt will be on the negotiating table,” he said. Eurozone leaders and officials — some of whom viewed the plebiscite as an in-out vote on Greece’s membership in the euro — scrambled to work out their response to Sunday’s `No’ vote.

German Chancellor Angela Merkel and French President Francois Hollande hastily called a European summit for Tuesday after stating the Greeks’ decision must “be respected”.

The European parliament president Martin Schulz has said it was up to the Greek government to present “meaningful, constructive proposals” for negotiation with the other 18 eurozone states otherwise “we are entering a difficult and very dramatic time”. He said the European Commission was ready to organise an humanitarian aid program so that the poor, ill and children should not pay a price for the dramatic situation the Greek government had brought about. He also said the statements by Greek finance minister that the banks would be able to reopen on Tuesday was “difficult and dangerous”.

Later Same Day 3:40pm

Greece’s Finance Minister Yanis Varoufakis has just announced his resignation in the wake of the country’s resounding rejection of international creditors’ tough bailout terms in yesterday’s historic referendum. “Soon after the announcement of the referendum results, I was made aware of a certain preference by some Eurogroup participants, and assorted ‘partners’, for my … ‘absence’ from its meetings; an idea that the Prime Minister judged to be potentially helpful to him in reaching an agreement. For this reason I am leaving the Ministry of Finance today,” Varoufakis, who had often clashed with creditors in negotiations over the past months, said on his blog after announcing the news on Twitter.

Announcing his resignation, Varoufakis vowed to wear the “loathing” of European leaders “with pride".

Though the maverick minister has always taken a stance protecting ordinary Greeks, his background was anything but common.

He is the son of Giorgos Varoufakis, who at 90 still heads one of Greece’s leading steel producers, Halyvourgiki. Giorgos had fought on the communist side with Albania, Bulgaria and Yugoslavia in the Greek Civil War (1946-1949) and spent years imprisoned on the island of Makronisos and in exile. Giorgos however eventually turned from United Democratic Left (EDA) to the socialist PASOK, founded in 1974, becoming chairman of Halyvourgiki. Yanis, his son, attended the Moraitis School which has alumni including prominent Greek leaders and artists. Yanis's early career was spent at the English universities of Essex, East Anglia and at Cambridge, linking with research into game theory.

In 1989 Varoufakis moved to Australia where he taught as senior lecturer at the Department of Economics of the University of Sydney, but he moved back to Greece in 2000 to teach at the University of Athens, and in January 2013 accepted a post at the University of Texas in Austin. On 25 January 2015, Varoufakis was appointed finance minister by Prime Minister Alexis Tsipras after the election victory of Syriza, promising a reduction and restructuring of Greece's debt and the abolition of austerity measures.

Extract: In Greece, ATM Lines, Bank Transfer Limits Enter Second Week

Charles Forelle

The Wall Street Journal

Tuesday, July 7th, 2015 5:05AM AEST

ATHENS: Many Greeks went to bed Sunday night jubilant after the runaway success of a referendum urging the government to push back in negotiations with its eurozone creditors. On Monday, they woke up to the start of a second week of restrictions on money transfers and lines outside ATMs.

The capital controls, which limit withdrawals to €60 a day and forbid electronic transfers outside of Greece, are fast choking the economy. The head of the country’s banking association said banks would remain closed through Wednesday; few expect them to open soon after that.

The European Central Bank tightened the screws Monday, demanding that Greek banks put up more assets as collateral to secure the emergency lending that is keeping them alive, if not fully functioning. The move doesn’t directly affect the amount of emergency loans they receive. It is unclear when they might run out of cash.

There are few, if any, signs of shortages on store shelves here. But further up the supply chain, importers and wholesalers warn that the flow of goods into Greece has sharply slowed. The restrictions have gummed up the wheels of commerce. No money in banks can leave Greece, so importers can’t write cheques or wire payments for goods. Some customers offer to pay cash, but it’s impractical to handle large quantities, and there’s no way to get it overseas.

One import agent has three dozen containers of lamb en route to the port of Piraeus by sea; they were diverted when capital controls descended last week. They won’t be delivered until he can pay.

Nikolaos Politikos, import manager at Politikos Bros., Greece’s largest livestock company, says he imports about 150 cattle per week. His suppliers have continued shipping, he says, because of long relationships. He says his bank said Monday that his invoices to foreign suppliers can be considered for payment under the government’s exceptions. He’ll know in three days. Time is tight. Given the low domestic production of beef, Mr Politikos says in an email that if—“a BIG if”—meat and livestock imports “are stopped completely we will probably last around a week.”

Greek PM Alexis Tsipras cuts hard to sway Dr No

Weekend Australian

Jacquelin Magnay, European Correspondent

Saturday, July 11th, 2015

ATHENS: Greece Prime Minister Alexis Tsipras has put forward a raft of reforms that are more severe than those roundly rejected by the Greek people in last week’s referendum but the intended payback may be a significant three-year deal worth as much as €53.5bn ($79.7bn). But can Mr Tsipras sell a third bailout? Not only to his own people, who see any conciliatory tones to Europe as traitorous, but to the ever-sceptical German people who will have to approve it.

As European stock markets responded positively Mr Tsipras’s proposals, officials from the European Central Bank, the International Monetary Fund and the EU were to brief the 19 eurozone finance ministers this morning on a third bailout for Athens and an emergency summit of all EU leaders would convene in Brussels late this day. “We got a mandate to bring a better deal than the ultimatum that the eurogroup gave us, but certainly not given a mandate to take Greece out of the eurozone,” Mr Tsipras told his Syriza party as he tried to get consensus. “Either we will carry on all together, or all fall together."

Keeping Greece in the eurozone, even with the increasingly vocal support of the US has become problematic for German Chancellor Angela Merkel, who will have to convince the Bundestag to extend Athens more money, some of which will be even more favourable terms than those of the suspended second bailout. Germany contributes 27 per cent of the capital for the European Stability Mechanism, through which Greece is seeking the latest financial aid.

In the new offer, Mr Tsipras has made clear how much being part of the eurozone matters and the desperation of his bankrupt country for some money to save its banking system: he has hiked tax rates, tweaked the VAT system, cut pensions, raised the retirement age to 67, cut defence spending and agreed to sell off Greek ports and regional airports in a €16bn reform package.

In return, instead of the €7.6bn of bailout cash left over from the last bailout package, he wants three years of support to enable the country to repay debt, which will rocket from €320bn to €380bn if the new deal is ratified. He also wants creditors to commit to restructuring the debt but this wasn’t explicitly detailed in the new plan.

But the German people who have already lent Greece €86bn (publicly, and privately) aren’t fussed about the details: they are simply sceptical of Greece’s intent to turn its economy around and don’t want to throw good money after bad. “The Greeks have the right to say no and we also have the right to say no,” said Hans-Peter Friedrich, a member of the Christian Social Union. Finance Minister Wolfgang Schaeuble, who was the vampire poster boy of the Oxi No campaign in the referendum, insists that Greece has not built any trust to earn any more German money. More than 100 of the 311 Bundestag members of Ms Merkel’s coalition are threatening to oppose any financial package for Greece. More than 55 per cent of German taxpayers don’t want to assist Greece any further. Ms Merkel point out the costs to Germany of a Greek reversion to the drachma would be far greater than providing new assistance.

If Greece does exit the eurozone, Ms Merkel’s political legacy might be that she oversaw a shattered Europe, as precariously placed Spain and Ireland, facing elections later this year, might be emboldened to do the same. The geopolitical considerations, which are a major concern of the US, may be significant if Greece turns to Russia or China for new aid. The fraught Franco-German relationship, will be tested too, for France has been the biggest supporter of Greece remaining in the eurozone.

Same Day 12:53pm AEST

Greek lawmakers back bailout reform plan

By ELENA BECATOROS and DEREK GATOPOULOS

Associated Press

Greece's parliament backed the government's reform plan containing austerity measures to win a third bailout early Saturday. The motion sought to authorize the government to use the proposal as a basis for negotiation with international creditors during the weekend. It passed with 251 votes in favor, 32 against and 8 voting `present' — a form of abstention — in the 300-member parliament. Former finance minister Yanis Varoufakis, who resigned this week, was absent for family reasons, saying on Twitter he was spending the weekend with his daughter who was visiting from Australia. Although he sent a letter saying he would have voted in favor had he been present, it could not be counted among the `yes' votes under parliamentary rules.

All opposition parties except the Nazi-inspired Golden Dawn and the Communist Party voted in favor.

Greece's major creditors — the International Monetary Fund, the European Central Bank and other eurozone nations — were already fine-combing through the proposals before sending them to the other 18 eurozone finance ministers Saturday. French President Francois Hollande described the measures as "serious and credible," though Germany refused to be drawn on their merits. France's Socialist government has been among Greece's few allies in the eurozone during the past months of tough negotiations, with Germany taking a far harder line.

Jeroen Dijsselbloem, the Dutch finance minister who chairs the meetings of the eurozone finance ministers known as the eurogroup, said the proposals were "extensive" but would not say whether he considered them sufficient. Meanwhile, banks remained closed since the start of last week and cash withdrawals were restricted to 60 euros ($67) per day. Although credit and debit cards work within the country, many businesses refuse to accept them, insisting on cash-only payments. All money transfers abroad, including bill payments, were banned without special permission.

Extract: Euro zone ministers demand more from Greece for loan talks

Andreas Rinke and Francesco Guarascio

Reuters

Sunday, July 12th, 2015

BRUSSELS: Sceptical euro zone finance ministers demanded on Saturday that Greece go beyond painful austerity measures accepted by Prime Minister Alexis Tsipras if he wants them to open negotiations on a third bailout for his bankrupt country to keep it in the euro. Ministers lined up to vent their anger at Tsipras on arrival at their umpteenth emergency weekend meeting on Greece's acute debt crisis, with Athens staring into an economic abyss when financial markets reopen on Monday unless it wins fresh aid.

EU officials forecast a deal would be reached by the end of the weekend to keep Greece afloat, but two sources said there was consensus among the other 18 ministers that the leftist government in Athens must take further steps to convince them it would honor any new debts. Tsipras won parliamentary backing early on Saturday for a tough reform package that largely mirrored measures previously demanded by its international creditors but rejected by Greek voters at his behest in a referendum last Sunday.

Wolfgang Schaeuble, finance minister of its biggest creditor Germany and a stickler for the EU's fiscal rules, said negotiations would be "exceptionally difficult". Emerging optimism about Greece had been "destroyed in an incredible way in the last few months" since Tsipras won power, Schaeuble said.

A German newspaper reported that his ministry was suggesting that Greece either improve its proposals quickly and transfer state assets worth 50 billion euros into a fund to pay down debt, or take a five-year "time-out" from the euro zone. The German Finance Ministry declined to comment on the report in the Frankfurter Allgemeine Sonntagszeitung. But several officials said no one raised the possibility of a Greek euro exit in the meeting, which took a pause after three hours.

Other ministers arriving for the Eurogroup session spoke of a fundamental lack of trust after years of broken Greek promises and six months of erratic and provocative behavior by the radical leftist Tsipras government. "We are still far away," said Jeroen Dijsselbloem, the Dutch finance minister who was chairing the meeting. "On both content and the more complicated question of trust, even if it's all good on paper the question is whether it will get off the ground and will it happen … We are facing a difficult negotiation."

Greece must do 3 things to get the bailout it needs

Alastair Macdonald

Reuters

Monday, July 13th, 2015

BRUSSELS: Euro zone ministers gave Greece until Wednesday to pass new laws as a condition for negotiations on a bailout Athens needs to avoid losing access to the common currency, Finnish Finance Minister Alexander Stubb said on Sunday.

Describing a joint proposal the Eurogroup of finance ministers have put to a summit of euro zone leaders which began on Sunday, Stubb told reporters: “It has far-reaching conditionality, on three counts: Number one, it needs to implement laws by July 15. Number two, tough conditions on for instance labour reforms and pensions and VAT and taxes.

And then number three quite tough measures also on for instance privatization and privatization funds.

And for us the most important thing is that … this whole package has to be approved by both the Greek government and the Greek parliament and then we’ll have a look.”

Later same day

The Australian, Wall Street Journal

EU President Donald Tusk said eurozone leaders had reached a unanimous deal to offer Greece a third bailout and keep it in the euro after 17 hours of marathon talks. “EuroSummit has unanimously reached agreement. All ready to go for ESM program for Greece with serious reforms and financial support,” Tusk tweeted, referring to the EU’s bailout fund that will oversee the third Greek bailout since 2010. “There will be no Grexit,” European Commission chief Jean-Claude Juncker announced.

Eurozone leaders thrashed out the Greek bailout deal overnight on Sunday (Brussels time) after giving Athens an ultimatum to accept harsh economic reforms or become the first country to be cast out of the single currency.

The most divisive step demanded by Greece’s creditors is the creation of a fund that would hold some €50 billion in state-owned assets slated to be privatized or wound down in the coming years. The fund will be under European supervision, Ms Merkel said. Most of the money raised will go to pay off Greece’s debt and help recapitalize its broken banks, while €12.5 billion can be used for investment, said Ms Merkel “The advantages outweigh the disadvantages,” she said about the deal, while warning that Greece’s path back to growth will be long and arduous.

Despite these big concessions by Mr Tsipras, Greece’s future in Europe’s currency union still hangs in the balance. Passing the tough new bailout measures through Greece’s parliament could split Syriza and its right-wing coalition partner, the Independent Greeks, which in turn could trigger fresh elections. There wasn’t an answer on when the country’s banks — closed for most business for the past two weeks — will reopen or how Greece will make a €4.2 billion payment to the European Central Bank on July 20.

The eurozone’s finance ministers will discuss how to come up with a mechanism to meet Greece’s short-term financial needs “as a matter of urgency,” Mr Tusk said at a news conference after the summit. A statement prepared by finance ministers earlier foresaw Greece’s financing needs rising to as much €86 billion, up from the €74 billion estimated on Saturday by the institutions representing Greece’s creditors. Recapitalizing the country’s broken banks is expected to cost between €10 billion and €25 billion.

The International Monetary Fund should continue to be involved in bailing out the country, said French President Francois Hollande, whose government has taken on a strong role in backing Greece in recent months.

In a concession to Greece, eurozone governments will discuss ways to make the country’s debt load more manageable later this year. Such measures can include giving Greece more time to repay rescue loans, Ms Merkel said. They won’t include a cut to the nominal value of rescue loans, she said.

As part of the deal, Greece’s administration will be modernized and de-politicized, Ms Merkel said, adding that the Athens government and international institutions will hold first talks on this matter on July 20.

|

Same Day

Extract: Greek business begs for EU deal

The Australian

Kiki Loizou, Athens, Sunday Times

A backtrack by Mr Tsipras, who championed last week’s “no” vote, was inevitable, said sources. “There are huge personal implications if he lets Greece fall,” said one source. “He would never get away with it.”

A last-minute deal could unlock a flood of new cash into Greek banks, the source said. Talks would resume between Alpha Bank and Spanish loan-servicing firm Aktua, which is said to be ready to buy up billions of euros of bad debt. Piraeus Bank and American private equity house KKR could resurrect similar discussions. Sankaty Advisors, the credit arm of Bain Capital, is also said to be circling some of the banks. “There are some spectacular deals in the pipeline,” he said.

But then comes the tough task of implementing the measures. The insider added: “Come September, we will be looking at another crisis. This needs about seven supporting laws. You can pass the VAT and probably the pension reforms immediately, but for the rest they must ask members of parliament to vote again and again for things they don’t want to implement.”

Following a deal, it could be days before Greek banks open their doors, he added. Some small businesses will not last that long. Pharmacists across the country continue to turn away the sick because they have run out of medicines. Retailers have lowered prices to all-time lows and some shop owners desperate for cash are offering customers extra products in lieu of change. Hotels and restaurants have reportedly been accepting Turkish and Bulgarian money. Small firms, which make up 99 per cent of Greek companies (96 per cent in the micro category), have never had it so bad.

“They have frozen payments to their suppliers and demanded cash for their own sales. Some of them have put employees on forced leave. Others are trying to move their entities abroad,” said Haris Makryniotis, the managing director at Endeavour Greece, which promotes and supports entrepreneurship. “There is a high quality of human capital in Greece but a significant amount has either left or plans to do so in the coming months. We run the risk of everyone leaving the country and having the old establishment continue to ruin it.”

Endeavour’s research claims it will take Greece 20 years to produce enough high-growth firms to make a dent in unemployment, which stands at 25 per cent — and more than 50 per cent among young people. But for now there are short-term issues to deal with, said Mr Makryniotis. “We will see the first shortages over this week and food suppliers are saying they will have dramatic shortages in basic food in the next month.” Some Greeks have been panic buying to bleed their accounts dry, he added. In fear of a tax on their deposits, shoppers have rushed to spend what is left of their savings on luxury goods, electronics and even cars. “We have spoken to car dealers who have seen an increase in sales over the past two weeks because people don’t want to hold on to their money,” said Mr Makryniotis.

Fotis Karpadelis, 42, has owned a pharmacy in central Athens for 10 years. “Look around Europe — many countries have austerity, not just Greece,” he said. He spent his days apologising to customers desperate for medicines he can’t get hold of. Many diabetes sufferers are going without insulin, “as well as blood-pressure tablets and many other medicines”, he said.

The only Greek businesses winning are the technology start-ups run by entrepreneurs who focused on exports and do not rely on revenues from home. Nikos Moraitakis, 38, is one of them. His business, Workable, which provides recruitment software for businesses, is barely three years old yet its sales have increased tenfold in the past year with the help of 2000 customers, 95 per cent of whom are not in Greece. “The psychological consequences of what’s just happened are going to be huge and for the start-up community it means that there could be a temptation to move away from Greece,” said Mr Moraitakis. While the firm with 45 staff still has a base in Athens, Mr Moraitakis has offices in London, New York and Boston. He plans to hire a further 50 people this year. “We haven’t had a single start-up shut down while the banks have been closed and that’s because there has been a huge amount of community spirit, with founders dipping into their pockets to help other entrepreneurs,” he said.

Som Sinha, 40, is an Indian entrepreneur who set up Intellibox in Athens last year. He moved his headquarters to London, but kept a team in Greece. “I can’t tell you how cheap it is to hire talented people there. They are so smart,” said Mr Sinha, whose venture identifies the value of used mobile phones for retailers trading them for discounts on new phones. “We would have to pay triple for people with the same skills in London … There are big opportunities there now. Somebody’s problem is another’s opportunity.”

Extract: Greek leader home with bailout deal

but faces dissent over deep cuts ahead

Anthony Faiola and Ylan Q. Mui

Washington Post

Tuesday, July 14th, 2015

ATHENS: Greek Prime Minister Alexis Tsipras capitulated in Brussels to keep his country part of the euro. He returned home hours later Monday to find a nation split apart with the difficult task ahead of uniting lawmakers behind a deal they once denounced. After a marathon, 17-hour summit that turned into one of the most contentious diplomatic standoffs in European Union history, Tsipras acquiesced to a punishing ultimatum from European leaders. In exchange for a €86 billion rescue — Greece’s third in five years — he agreed to lightning-fast passage of reforms starting Wednesday, and a pledge to strap his nation into a fiscal straitjacket to save its banks and stay in the euro common currency.

He agreed to far more than simple austerity, pledging even to stage what may amount to a fire sale of Greek utilities, even plots of land on its islands, to help pay back its huge debt.

For a man once seen as a leftist maverick who had pledged to free Greece from the shackles of financial injustice, his decision to surrender to European demands immediately sparked an insurrection within his unlikely ruling coalition of the far-left and the far-right. The one thing his allies had in common was a joint enemy — Greece’s creditor nations in Europe. And now he faces a tough and humbling battle to rush it through parliament. Every point is a potential political fight. They include creditor-demanded overhauls to the Greek tax and pensions system.

He may have to expel renegades from his Syriza party and look to make other political alliances of convenience to get the package through the 300-seat parliament. Without an official blessing from parliament, the promised financial lifelines could be pulled back and Greece would be pitched back into full-scale crisis. “The champagne bottles should still remain in the fridge for a while,” wrote Carsten Brzeski, chief economist at ING Direct Bank in Frankfurt.

Financial markets welcomed the news after wild swings over the past weeks. Main stock exchanges in Asia and Europe were higher. Wall Street also jumped. The euro exchange rate against the US dollar dropped slightly.

Speaking to reporters in Brussels after the summit, Tspiras sounded strangely at times like his nemesis — German Chancellor Angela Merkel — whose nation led a bloc of euro zone countries that forced a tough deal. “Today’s agreement maintains liquidity and gives hope of recovery,” Tsipras said as he left the summit in Brussels, according to a translation in Greek media. “We know a deal will be difficult to implement and may be recessionary.” To keep up the flow of cash if a bailout is approved, Greece must take dramatic and monitored steps to modernize its economy by introducing competition into everything from bakeries to drug stores, sell off power companies and introduce labor market reforms.

Successful passage, however, would not guarantee that Greece will be saved. Rather, it would merely open the door to a final agreement this week for a bailout carrying far more onerous conditions than a deal rejected in a Greek referendum on July 5. The strict pact was portrayed by hard-line nations including Germany and Finland as essential to restore trust in the unpredictable government in Athens. But it was also a financial gun to the head: If Greece rejected the proposal or fails to fully comply, its banking system could collapse within days.

Merkel on Monday offered cold comfort for the Greeks. “All and all, I think you can say the advantages outweigh the disadvantages,” Merkel said. If the program is strictly followed, she said, “I think there is a possibility to return to the growth path, but it is going to take a long time and it is going to be an arduous road.”

At home in Greece, calls from the left had been growing throughout the evening for Tsipras to reject the deal and accept the dire consequences. Seventeen Syriza members did not support his request for a bailout from Europe last week. The next day, 15 members of Syriza who initially supported the plan vowed not to do so again.

On Monday, one of the leaders of Syriza’s parliamentary group posted a message Facebook calling on Tsipras to leave Brussels and hold a new round of elections. “Do not accept it!” he wrote. “Cancellation of the bailout!” On Twitter, the hashtag #ThisIsACoup was trending Sunday with calls for Tsipras to reject the deal. The prime minister’s Facebook page was flooded with comments urging him to defy Greece’s creditors: “Whatever happens, do not give up! We will fight together until the end!” one user wrote.

Two sticking points held up an agreement until 10 am Brussels time. One was the involvement of the International Monetary Fund, which Greece was compelled to accept. The Greeks also bristled at demands to put up 50 billion euros in assets that could be sold off to recapitalize banks and pay back debt. Ultimately, Greece was largely forced to swallow the measure, although it won a concession to funnel some of the funds to stimulus.